ASX Weekly Turnkey Strategy

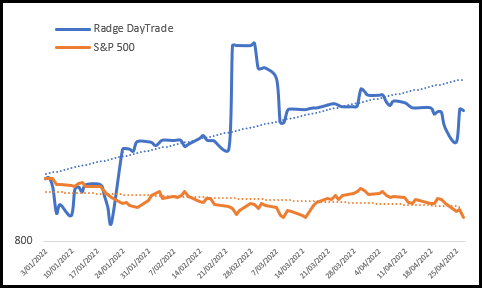

The team has been working on a few new strategies that may be included in our Turnkey Strategy lineup. Feedback has suggested weekly strategies tend to be popular because of their minimal workload. To this end, we’ve been working on a weekly swing strategy that buys a dip after a jump in volatility. Trades are placed on […]

Read more