ASX Weekly Turnkey Strategy

The team has been working on a few new strategies that may be included in our Turnkey Strategy lineup. Feedback has suggested weekly strategies tend to be popular because of their minimal workload.

To this end, we’ve been working on a weekly swing strategy that buys a dip after a jump in volatility. Trades are placed on Monday and any filled positions are exited on Friday’s close.

I don’t currently use a strategy that trades short term in Australia. I’ve got some that do well, but the cost of brokerage and slippage is such that I have avoided very short timeframes. However, this weekly variant has lower turnover, about 3 – 4 trades a week, so slippage and commission drag is better controlled. It could be a nice portfolio filler for me.

The strategy looks for stocks going through a period of higher volatility, showing near term upward momentum and then has some minor weakness which we’re looking to buy.

We do not use an Index Filter so the strategy trades during all market conditions. Also, like all our strategies, rather than use stops, this strategy uses exits.

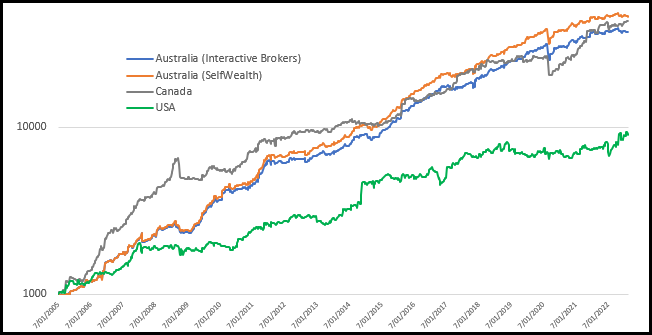

The following equity chart shows the strategy traded on the full ASX market (4000+ stocks) using 10 positions, each allocated 10% of capital. It’s important that liquidity constraints are taken into account. For this exercise we’ll only trade stocks with turnover exceeding $1m for the last 5 weeks, and our trade size will be capped to a maximum of 10% of the traded volume. Smaller accounts could lower these restrictions.

Equity Chart

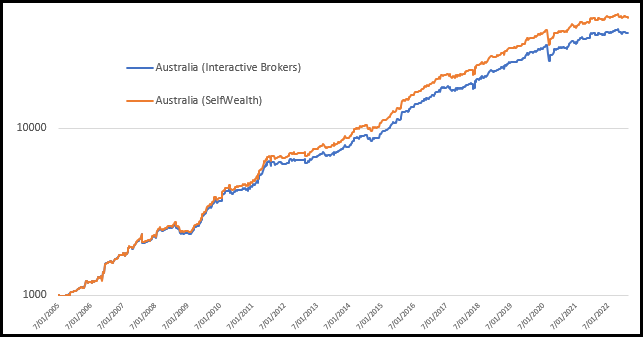

I have used two different commission brokers for comparison. SelfWealth offer a flat fee of $9.50 per trade, so over time that’s going to prove to be quite the saving. Interactive Brokers on the other hand have a minimum $6 per trade but then reverts to 0.08% of trade value.

Costs aside, Interactive Brokers do offer tools that will make managing the portfolio significantly easier. Using their Basket Trader facility, one can upload all trades quickly and easily then allow non-executed trades to be automatically cancelled at some stage on the Friday. Their platform potentially has the ability to exit open position on the Friday closing auction (I’m still trying to figure than one out).

On the ASX the strategy has a CAGR of 24.2% with a maxDD of -18.5% with a win rate at 58%. Not too bad. Loosening the liquidity restrictions will enhance those numbers.

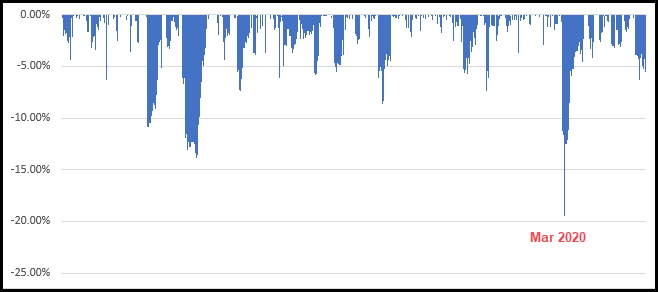

Below is the Underwater Equity which shows us the drawdown history. Prior to the March 2020 COVID crash, the maxDD was -13.5% and the CAGR was running at +27.3%. The good news is the average drawdowns are very low and the larger ones get recovered quickly.

Underwater Equity

This strategy was built specifically for the Australian market. Albeit pieces have come from an existing strategy of mine that trades the US market. To test robustness we’ll use the exact same strategy on the US and Canada. The only difference is the minimum price for these markets will be $1.