Looking back on 2022 and towards 2023

Nick Radge reviews the charts for 2022. What was that all about and what can we expect for the year ahead?

Read more

Nick Radge reviews the charts for 2022. What was that all about and what can we expect for the year ahead?

Read more

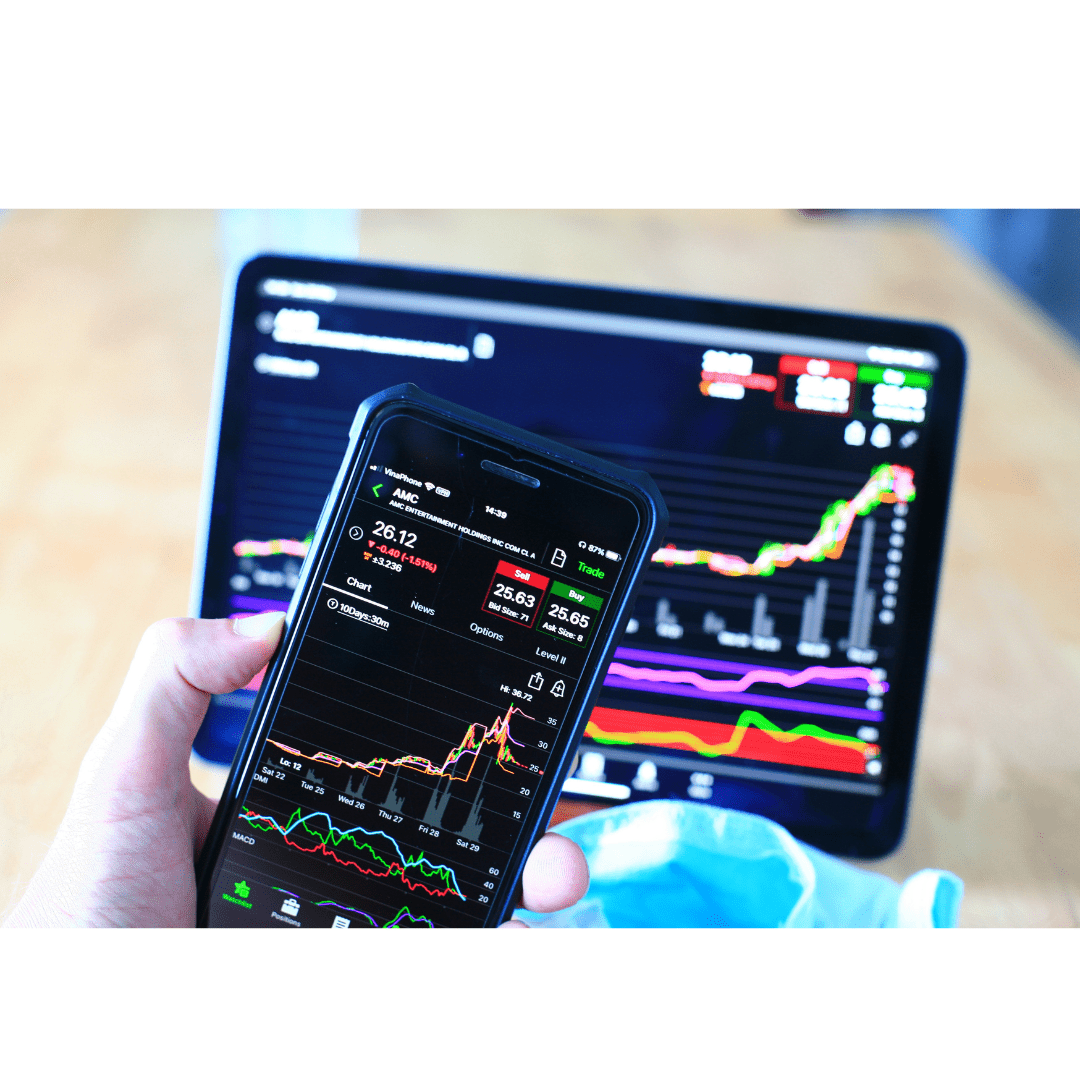

2023 is here and the new year brings with it the promise of new opportunities. Whether you are a novice or an experienced trader. Now is the perfect time to look back on the lessons learned from 2022 and develop strategies for a successful trading year ahead. It is important to remember that trading involves […]

Read more

Global Chart Analyst, Scott Goddard, technical view of the US Stockmarket – Technical Outlook. December 2022. Bottom Line Daily Trend: Neutral Weekly Trend: Up Monthly Trend: Neutral Support Levels: 3600 – 3400 Resistance Levels: 4200-4300/ 4638 / 4819 (all-time highs) Technical Discussion We remain near-term bearish until the 4200-4300 resistance level, which is above the […]

Read more

As I’m travelling this week and we’re heading into the holiday season I thought it was timely to share info about how to manage your trades whilst on holidays. I’ve written about how to manage your trades whilst on holidays here. It’s also worth noting the dates the ASX is closed over the holiday period. […]

Read more

I talk about equity declines, aka drawdowns, a lot. Why? Strangely enough, most retail traders are completely happy when making money, but seem to have significant problems when losing money. You can view a selection of my articles about drawdowns HERE. Let’s take a look at drawdowns from a different perspective. Below is the incredible […]

Read more

I commonly post some of my strategies with Radge tweaks. There are a number of reasons why. Firstly, the more money tracking a strategy, the more likely that it could deteriorate over time. People are naturally greedy. They could front run an entry or exit in order to beat other followers. Worse, they could trade […]

Read more

We’re pleased to announce that we’ve officially added a new strategy to our existing line-up of turnkey trading systems. Feedback has suggested weekly strategies tend to be popular because of their minimal workload. As such we’re introducing the ASX Weekly Swing strategy. Like our other short term strategies, the ASX Weekly Swing Strategy looks for […]

Read more

We’ve received a number of questions about the Growth Portfolio performance recently so Nick Radge has put together an update, explained the performance and how to manage the current market situation. If you have any questions about the Growth Portfolio performance update please drop me an email. Nick and Trish Radge trade the Growth Portfolio […]

Read more

Recently I mentioned that liquidity constraints were an important factor when thinking about trading or investing. Not only is it imperative that a strategy is scalable, at least to some degree, but also moving in and out of positions shouldn’t disrupt the market. History is littered with examples of liquidity blow-ups, the most prominent being […]

Read more

I received a question from a member of our Trade Long Term service and I feel it’s worth investigation. Is it possible to simplify the Trade Long Term strategy by just trading a leveraged ETF rather than the individual stocks? As I always say, let’s test it. For this exercise we’ll compare the existing Trade Long Term (TLT) strategy (monthly signals) […]

Read more