Testing a Momentum Strategy with a 52-Week High

Testing a momentum strategy with a 52-week high – a question from Michael G.

“Have you ever backtested the momo (weekly) bull strategy- top 5 or ten stocks closest to 52-week high and then reload every week?”

I haven’t tested this idea but let’s do it now. Here’s how we’ll start.

- Calculate the distance from the 52-week high and rank strongest to weakest

- Buy the top 10 stocks with equal 10% allocation of capital.

- Repeat weekly, i.e. sell any stocks that fall out of the top 10 and replace with new ones

- Universe = Russell-1000 including all historical constituents. Liquidity = 500,000 shares on average over the last 50-days

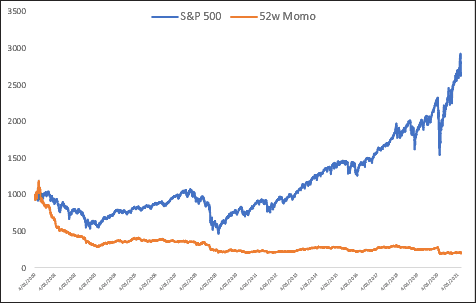

- Minimum price = $10. Maximum price = $1000. Commission = $0.005 per share or $1.15 Let’s take a look at the equity growth compared to the S&P 500.

So that’s a little gnarly… CAGR of -7.33% and a maxDD of -84.13%.

But long term readers should know, and Mentor Students will definitely know, taking positions without consideration of the underlying trend – of both the market and the stock itself, is a recipe for disaster. We recently wrote about that HERE and HERE.

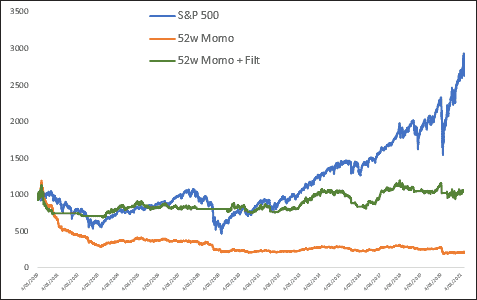

Let’s now adjust the strategy by adding a regime filter of 200-days to the S&P 500, and a stock filter of 100-days.

In other words, we only take a position if the S&P 500 is above its 200-day moving average, AND the symbol is above its 100-day moving average.

A slight improvement in equity growth, but still not a worthy trading strategy. The CAGR is about 0% and drawdown remains at an uncomfortable -39.56%.

We can do better.

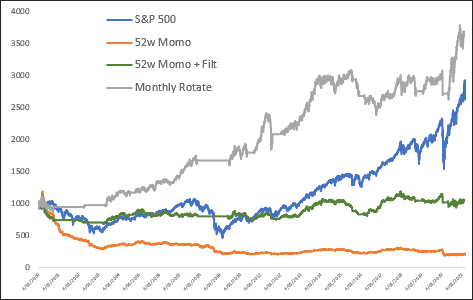

Let’s make one more change. Rather than trade the strategy weekly, we’ll take it out to monthly.

It appears moving out to a monthly rotation makes a considerable difference. Not only do we now outperform the S&P 500, the drawdown is also half that of Buy and Hold.

In my opinion, still not a strategy I’d trade, at least not in this format, but a great foundation from which to build from. There are further refinements that can be made to improve performance and reduce drawdown.

This is an important example of why, as traders, we must test and validate every idea. As we say at The Chartist

- Find a strategy

- Validate it

- Do it!