Meme Stocks vs Hedge Fund Titans

Hedge fund titans were thrown into chaos this week. We explain GameStop and the short squeeze that pushed a $12b hedge fund to the brink.

GameStop (GME) is a struggling, mid-size retailer stuck in a legacy business — selling physical video games. Being in such a business has attracted large hedge funds, such as Melvin Capital, who have been betting (short selling) that the company goes bankrupt and its shares fall to zero.

However, in a weird turn of events over just a few days, the share price of GME rose from $20 to almost $500.

The Big Short

The rise has been fueled by a massive short squeeze instigated by thousands of small individual investors who are using sites like Reddit and Robinhood to drive up the shares of these heavily shorted companies. Many are labelling it as a new revolution against Wall Street titans.

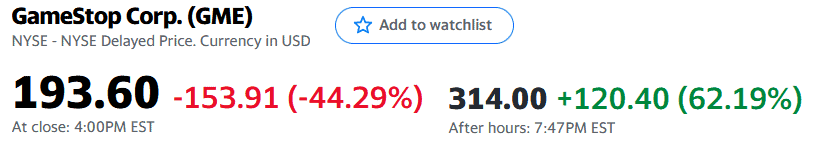

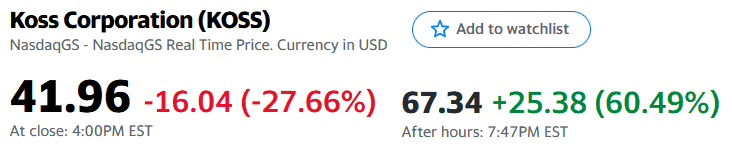

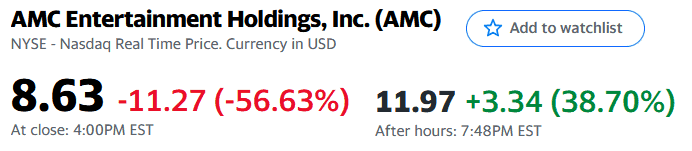

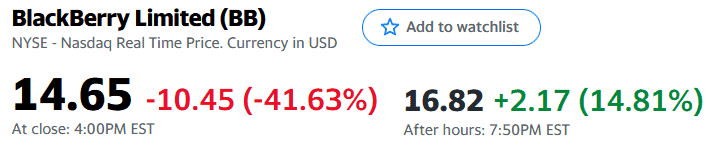

It hasn’t been limited to GME. Indeed the trend has moved to other names as well, such as KOSS, AMC and BB. Some of these have gained in excess of 3000% in a matter of days.

Take a look at some of the volatility in just the last 24-hours in both regular trading and aftermarket trading. Crazy stuff!

This is not the first time there have been massive short squeezes; famous examples include Kodak and Hertz.

What these ‘meme’ stock traders are doing is, in effect, exploiting the opportunities created by social media to disrupt the normal workings of the stock market.

What we’re seeing in the last 24-hours is action from the SEC, Federal Reserve and many brokers. The action is to alleviate the situation and return the market to a ‘more stable’ operating environment. To do so means margin rates have been increased by up to 300%. Options trading has been put into liquidation.

Can it get any worse? Apparently so.

Robinhood traders have now filed a class-action lawsuit against the company’s decision to restrict the transactions of individual investors. Hedge fund titans continued to be allowed to trade the stocks freely.

This is so 2000’s.

Update 2nd June 2021: ASIC has released an information sheet on Activist Short Selling in Australia