Financial Year – Reflecting on H1 2021

That’s a wrap for the financial year here in Australia and probably a time to reflect on where we were this time last year.

As fellow traders, this time last year we’d been gob-smacked by the severity of the COVID sell-off and then dumbfounded by the “V-shaped” bounce driven by global central banks.

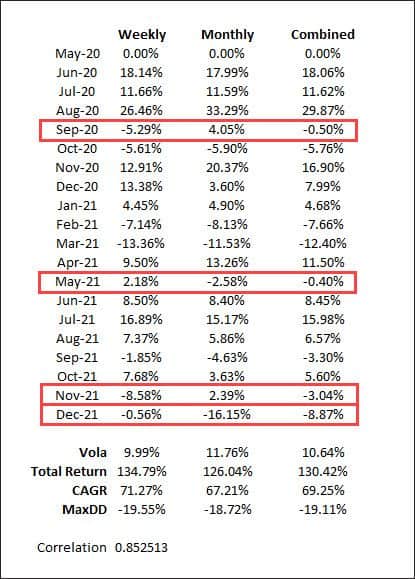

It wasn’t anywhere in my thoughts that the balance of 2020 would yield a record year for me personally, which I detailed in this article in January.

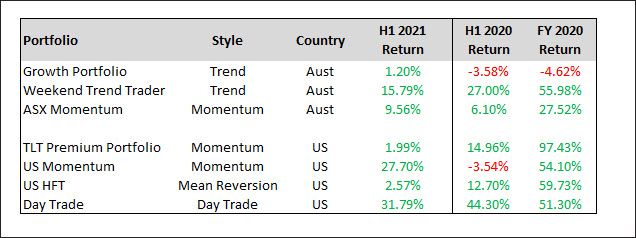

The table below shows my portfolio returns for YTD 2021^, and compare those to where we were at the same time last year, and at the close of 2020.

*Note – the Australian financial year (FY) is July-June

Some portfolios continue to struggle, specifically the Growth Portfolio for which I’m less than 50% invested. This stalwart portfolio is now front and centre of my research efforts to get performance moving back in the right direction.

Another ongoing area of focus is my Day Trade system. Over the last 6-months I have adopted a more advanced position sizing and portfolio construction algorithm. It’s my intention to continue shifting longer-term trend allocations to the shorter-term durations to gain more balance.

A quick glance at performance so far for H1 2021 is that short-term performance is random, just like the markets. If you focus too much on the recent past, you’re more likely to fail at achieving those long-term goals you’re always aspiring to.