The Importance of Regime Filters – Part 2

Last week we discussed Regime Filters and tested their significance on two longer-term trend style strategies. If you missed that, read about it HERE.

The conclusion was that a regime filter can reduce drawdown by a reasonable amount, yet not overly impact returns. For the record, every longer-term strategy I trade, and those that we use in our various membership portfolios, all use regime filters of some type.

This week we’ll turn our attention to shorter term strategies.

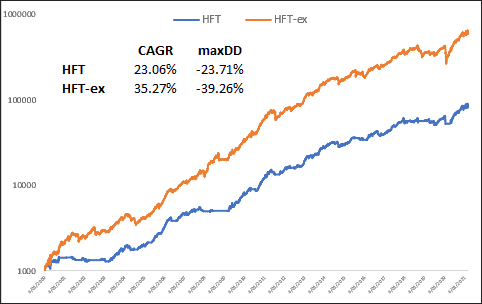

The first strategy is our US High Frequency Portfolio which is a long-only mean reversion system that holds positions for 3 – 4 days. It trades the entire Russell-1000 universe and is best suited to using 50% LVR.

The equity curve (log scale) is very strong for both, as is the MAR ratio (CAGR/maxDD).

|

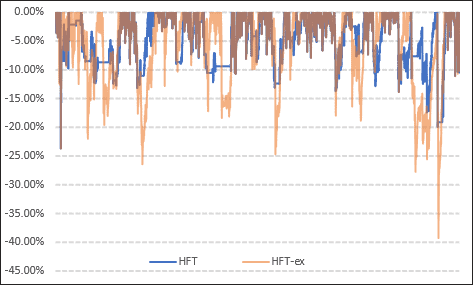

The growth between the two however is extremely large and will certainly add up to be a significant amount over time. Note in last week’s comparisons we didn’t see such a wide disparity of growth. That said, excluding the regime filter comes with the uncomfortable drawdown of 39%. But what does the average drawdown look like? If the -39% was a one-off and all other drawdowns weren’t so extreme, maybe it’s worthy of pursuing as a more aggressive part of the portfolio allocation? Let’s take a look… |

So without the regime filter the strategy has a single maxDD just shy of 25%. Excluding the regime filter there have been a few excursions to -25% and just the one nasty one to -39%.

And for the record, this High Frequency Portfolio as presented to our members does NOT use a regime filter. We only use regime filters on longer-term strategies.

Let’s now look at a day trade strategy.

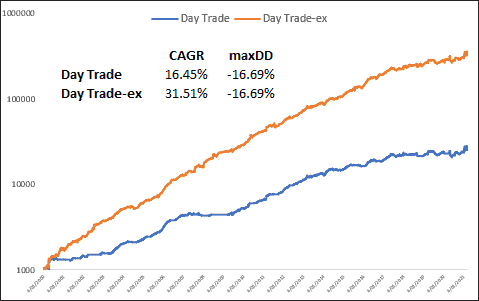

The example we’ll use today is from our Turnkey Code lineup, namely the Day Trade (Long) strategy. Again, it’s designed to trade the Russell-1000 constituents on the long-side but will exit at the close. Without overnight exposure the drawdowns tend to be smaller which then opens itself up to be leveraged. For this example we’ll use Pattern Day Trader margin.

Well, that’s a significant difference right there. Removing the regime filter doubles the return without any increase in the maxDD. Why?

Because this style of strategy revels in volatility. Think about it. The strategy looks to buy weakness in stocks that are trending up. In sustained bear markets there is a lot of fear and there tends to be over-reaction to bad news, especially early in the trading session. That over-reaction is bought with this style strategy and when the market calms it ‘tends’ to adjust itself higher.

And also remember that during sustained bear markets, using a regime filter will have you sidelined. So for the most of 2008 and early 2009, when the market was really packing a volatility punch, the regime filter had you sitting in cash.

The take away here is that by using robust techniques to test our theories, we can make a more informed decision as to whether we’re prepared to ‘ride the beast’ for higher returns, or use the regime filter to get a much steadier, yet lower return.