2021 Report Card

2021 Report Card is ready. When it comes to trading, I don’t like to use the word disappointed. Disappointment portends expectation.

And one should never have an expectation when it comes to the market.

Take each day, week, month and year as it comes, yet remain focused on the long-term expectation of what the investment strategy will deliver.

2020 was a record year, so 2021 was always going to be some type of reversion to the mean. While all the strategies returned positive results for the year, there was some increased volatility, a slap or two across the face and a few other lessons to dwell on. But hey, that’s trading.

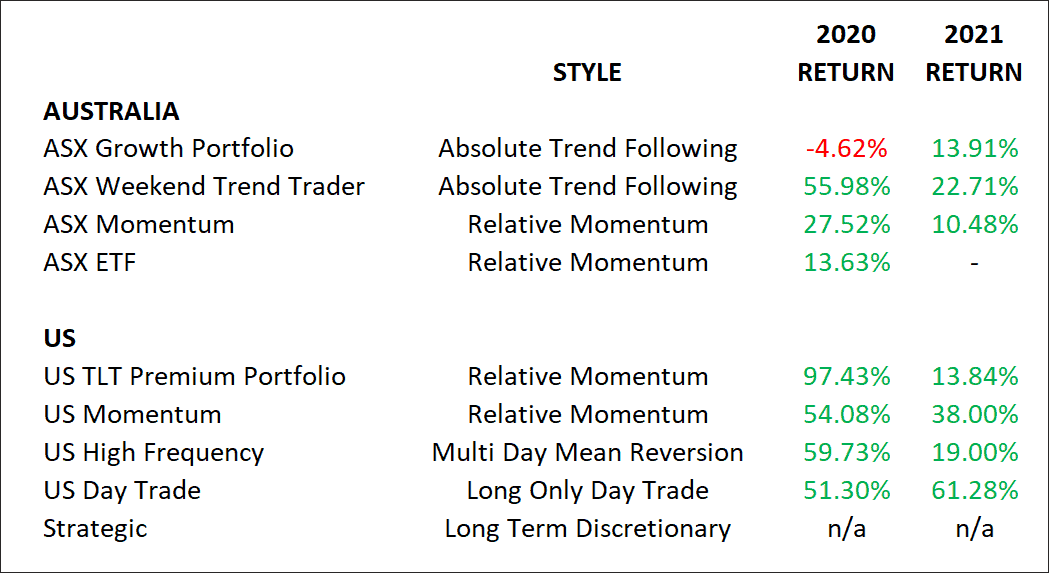

The following table outlines the various portfolios Trish and I trade.

In 2021 I discussed the performance of the Growth Portfolio and why some changes were needed. The research was done and I started beta test trading those minor tweaks into the end of the year. As of January 1st, those changes have been put into place for members to initiate. There were two changes;

- A small adjustment to a parameter setting

- Dividing the portfolio into two; the regular style where trends are followed using a trailing stop, and a Defensive version where positions are exited immediately on a trend change.

Both have Pros and Cons and members are able to make an informed decision on which is more suitable for their own situation. A detailed performance review can be downloaded here.

After the COVID crash in March 2020 we started thinking about Signal Luck, specifically in relation to our Trade Long Term Premium Portfolio. That was discussed in more depth HERE and more recently HERE. After the COVID crash, we divided the Premium Portfolio, which was originally just monthly, into weekly and monthly sub-portfolios. Interestingly this diversification within a portfolio has benefits in 2021. The monthly variant showed considerable volatility during the year, firstly as $TSLA reversed its 2020 form, and then $MRNA stormed higher, only to lose ground very quickly. The monthly portfolio finished the year at +6.55% which is well short of the index. However, the weekly variant returned +22.1% and combined the portfolio returned a little more respectable +13.8%.

The US Momentum was able to string another strong year onto 2020’s performance. And the Weekend Trend Trader remains as robust and reliable as ever returning +22.71%.

Another change during the year was increasing the universe for my own High-Frequency strategy from the Russell-1000 to also including the Russell-2000. This increase in trade frequency will perk up returns, but also volatility. At this stage, I’ll keep trading that additional universe with my own funds for further assessment.

Lastly, the Day Trade strategy was able to return +61.2%. During the year, using new research, I greatly enhanced my portfolio construction and position sizing. This increased trade frequency considerably which in turn allowed the mathematical edge to be exploited even further.

If you need further guidance or know someone wanting to start, just drop me an email.

Here’s to 2022 and #next1000trades.

Nick