Why am I in cash?

Financial markets are currently experiencing a whirlwind of activity, characterized by some unprecedented movements in various instruments.

Bond yields are surging to levels not witnessed since 2007. More concerning, however, is the remarkable increase in correlation between bond and stock prices, a phenomenon rarely observed in the past four decades.

In the last 18 months, prices in the US 20-year Bond Total Return Index have plummeted by approximately 40%.

Additionally, the yield curve has remained inverted for over a year, typically serving as a warning sign for impending economic challenges. That said, central bank rhetoric still seems to lean towards higher interest rates.

Despite the looming threat of rising inflation, Gold, often a hedge against inflation, is experiencing a decline in 2023, down by about 15% so far.

Summary

In summary, financial experts are currently scratching their heads, attempting to decipher these complex market dynamics.

For me, I’m not grounded in predictions or forecasts. Rather, I focus on trends that systematically allow me to navigate the markets with a level of certainty and some degree of comfort.

Those trends are now down so I’m sitting in cash and here’s why.

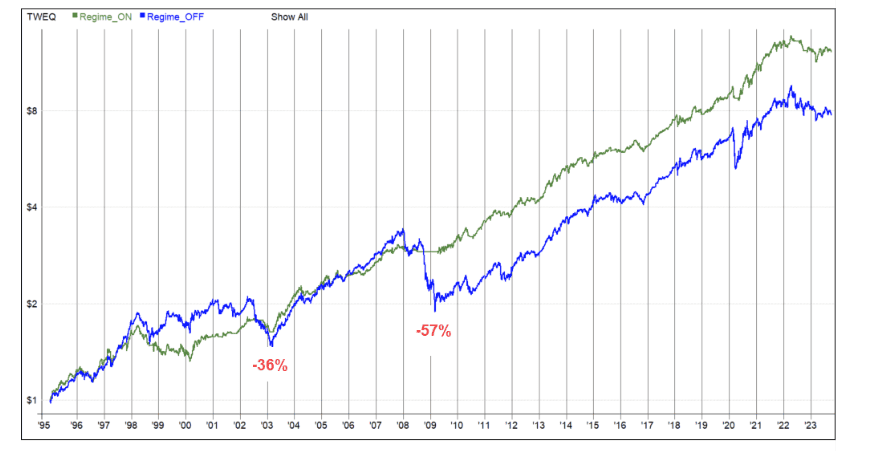

The equity growth chart below shows a simple trend following strategy that trades the Russell-1000 constituents.

The blue line takes the buy signals regardless of the direction of the broader market.

The green line, however, will only take buy signals when the broader market index, in this case the S&P 500, is trending up.

This is called a Regime Filter and the reason we use it is that when things go bad, sometimes they can go really bad.

During the 2001 – 2003 bear market, the strategy declined 36%. Then, in 2008, the sustained bear market saw it fall some 57%.

Compare that with the other alternative of getting out. It only suffered a 26% decline in the late 90’s, yet was almost completely unscathed in 2008.

Not only does going to cash help financially, but it also helps in our headspace as well. Success in this game comes from using a simple strategy and applying it for the long term. If we get scared, then chances are that the long-term application isn’t going to happen.