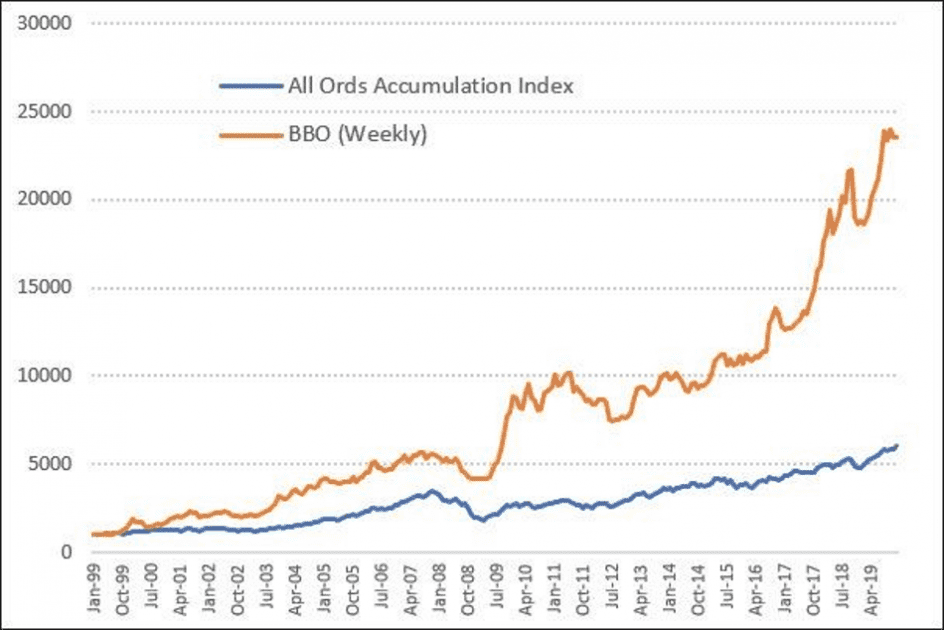

Best Market Conditions To Invest?

It’s no secret that I’m going through a drawdown at the moment. It’s not the first and I’m sure it won’t be the last. The more important question is why? After all, if you can’t answer the why, you’ll find it very uncomfortable to continue with the process. In my case its obvious and why […]

Read more