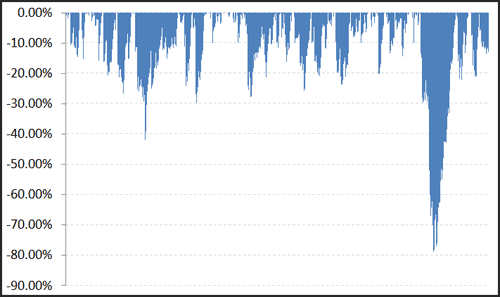

Experiencing Drawdowns

Markets are extremely volatile at the moment and are expected to remain so for the foreseeable future. If you missed my market commentary from last week you can watch the video here. Many strategies are experiencing drawdowns in this environment. While these are never comfortable, they are an integral part of the trading process. I strongly […]

Read more