What is Financial Repression?

It sounds ominous, but financial repression occurs when governments attempt to inflate their debt away. While it may benefit the government, it can be challenging for individuals and investors seeking higher returns on their savings because interest rates cannot keep up with inflation.

Investors might turn to equities in search of higher returns, potentially driving up stock prices. However, this can create a situation where stock prices may not be fully reflective of the underlying economic fundamentals, leading to a market that is more susceptible to corrections. There is considerable chatter about this with regard to US equities, namely AI stocks and the Magnificent 7.

In situations where inflation is rising or likely to rise, the appeal of real assets such as precious metals, certain industrial and agricultural commodities as well as real estate tends to grow. Gold has a unqiue ability to sniff out trouble before it comes to light.

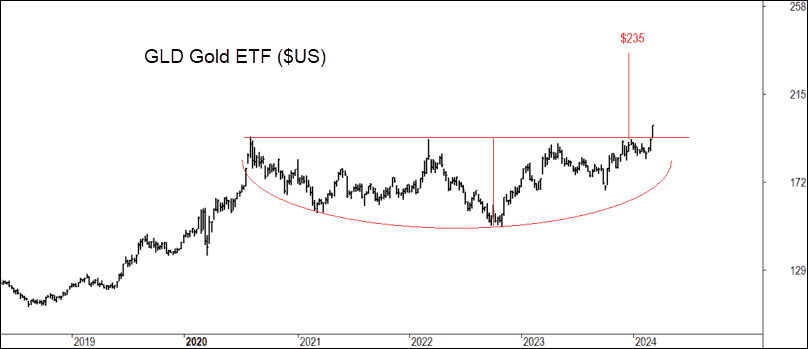

The following chart is the US Gold ETF (GLD) which is breaking out of a multi year base which potentially portends a possible 20% rise over the coming months. Is this the canary in the coal mine?

The dilemma faced by those who anticipate an imminent equity correction is the potential missed opportunity for substantial gains. In the past week, I’ve engaged with two clients who have reservations about government debt and have remained in a cash position for the past four years. While there is wariness about the market, it’s essential to acknowledge the excellent performance of equities, particularly in the robust years of 2020 and 2021. Despite concerns, these periods proved to be exceptionally lucrative for those actively participating in the market.

Best of Both Worlds

So, the key question becomes, “How can I capitalize on the upward momentum in equities while navigating potential financial repression if it comes into play?”

In recent discussions, I’ve introduced our All-Weather strategies available to our members. We have tailored options for both Australian and US ETFs. These portfolios are diversified across various asset classes, including Gold. Notably, both the ASX and US versions have maintained a long position in Gold since August of last year. Additionally, they hold long positions in NASDAQ stocks, which, as you’re likely aware, have experienced significant upward trends. And if you’re in the Bitcoin ‘alternate currency’ camp, the US strategy has exposure there as well.

The unique advantage of these strategies lies in their diversified assets classes and selective approach, only entering positions in assets that are on an upward trajectory. In the event of an anticipated equity correction, the strategy involves systematically selling these assets and moving to a cash position.

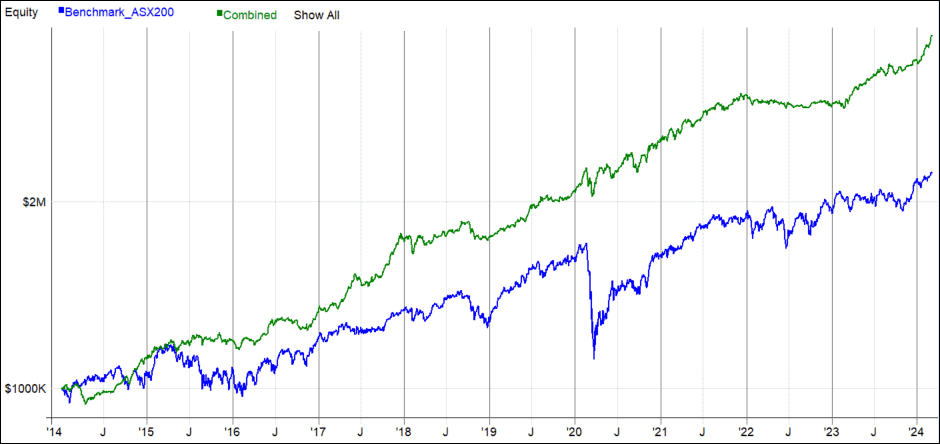

I’ve received numerous inquiries from clients curious about the return profile when combining both the ASX and US All-Weather strategies. Below, you’ll find the equity growth curve in Australian Dollars, rebalanced on a monthly basis.

A balanced 50/50 distribution between these options indicates a very positive result, yielding returns at +13.7%, minimal drawdowns at -9.9%, and notably lower volatility at 7.5%. This volatility is less than half of the benchmark’s, underscoring its stability. Crucially, the correlation stands at 0.28, suggesting it as an excellent tool for diversification when compared to conventional portfolios.