To Leverage or Not to Leverage

The Chartist has unveiled their two All-Weather strategies. Currently, these offerings are exclusively accessible to existing clients. They will also be made available to new members and investors in the upcoming months through a retail fund.

The All-Weather strategy aims to deliver low volatility returns in diverse economic conditions while steering clear of prolonged asset downturns. To achieve this goal, the portfolio will use a variety of Exchange Traded Funds (ETFs) listed on either the ASX or the US exchange.

These portfolios are crafted to serve as a core or satellite component within an investment portfolio. It caters to investors aiming for capital growth and income distributions over a medium to long investment timeframe, with a risk/return profile falling at least within the medium range.

An immediate question I received from several members was;

Can I use a margin?

From a philosophical perspective, the core concept behind this portfolio is to mitigate volatility. Introducing any form of leverage contradicts this principle, especially since margin usage amplifies all aspects of the strategy.

To quench curiosity, we’ll put it to the test and let the data speak for itself. There are various methods to incorporate leverage.

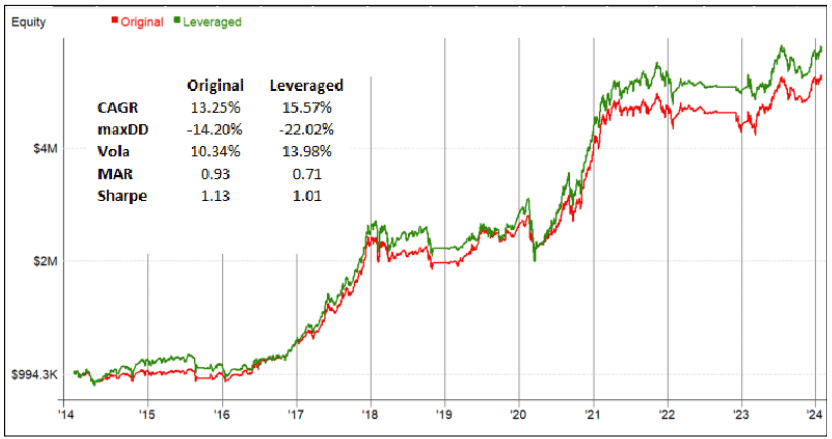

The first, and most obvious, is to replace the equities component, namely the QQQ, with the leveraged version, the QLD which is 2x the QQQ. Here’s how that looks.

QQQ

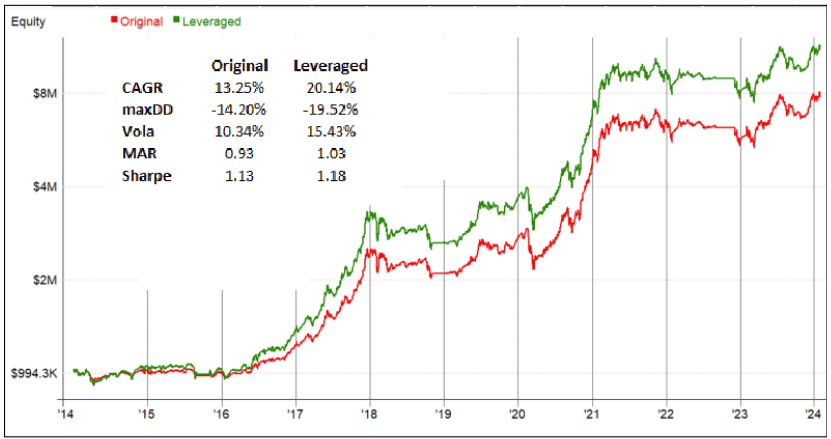

The alternative approach involves running the account at a 50% Loan-to-Value Ratio (LVR), meaning we invest $150 for every $100 in cash. In this case, each asset allocation will maintain the same percentage.

LVR

All-Weather portfolios are designed to minimize volatility and provide stability across various market conditions. Introducing leverage can disrupt this balance, as it tends to amplify price swings. The increased volatility may lead to a more unpredictable and potentially riskier investment environment.

While leverage can offer the opportunity for increased returns, it comes with the trade-off of heightened risk and potential volatility. Therefore, a thoughtful and measured approach to leverage implementation is essential to maintain the integrity of an All-Weather portfolios design.

If you’d like to code and test your own ideas, join The Beginners Guide to Building Trading Systems. In this course you will learn how to design, build, backtest, stress test, validate, and fine-tune trading systems tailored for your personality, schedule, risk appetite, and lifestyle.