Diversifying with ETFs

Over the past 18 months I’ve been developing a series of ETF-based strategies called All Weather strategies. The goal is to reduce portfolio volatility and move away from a solely ‘long-only’ equities approach.The progress on these All Weather strategies is promising, and they will be available in different formats over the next few months.Additionally, I’ve been collaborating with a mentor client on a more dynamic and short-term ETF portfolio. This particular portfolio involves trading across 30 different ETFs using 6 distinct strategies.

In a discussion about this portfolio, a Twitter follower posed the following question:

“Any suggestions on resources, podcasts, blogs etc. that will assist in exploring this idea/structure further for those that are interested?“

I have discussed strategy design before, HERE and HERE.

One of the strategies within this ETF portfolio comes from an article in Technical Analysis of Stocks and Commodities I read back in 2012. The strategy was specifically targeting the VanEck Gold Miners ETF (GDX).

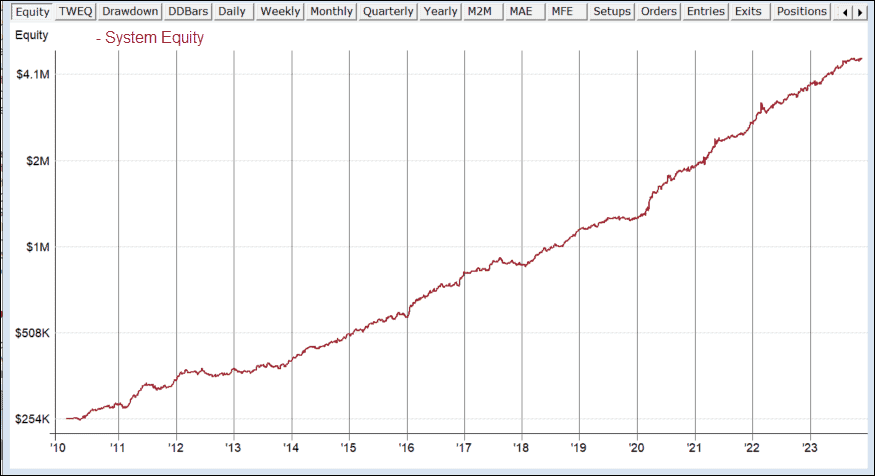

The equity growth chart below shows how this strategy has performed over time.

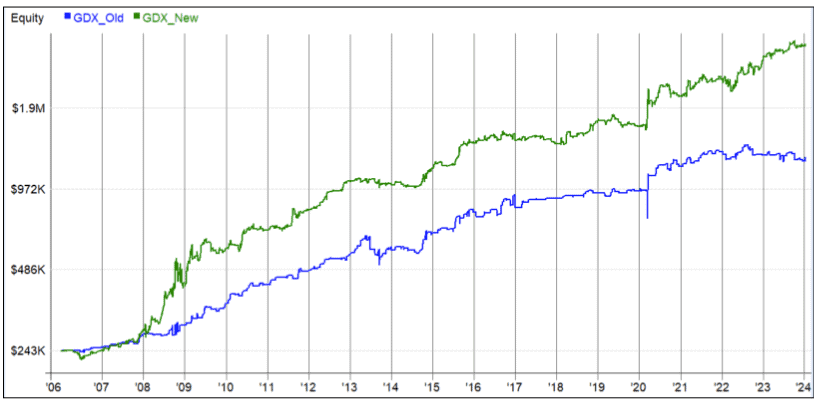

Fairly decent, but performance plateaued in recent years. Operating as a single-market system introduces extra risks—such as the potential randomness of the pattern and its likelihood of fading over time. To mitigate these risks, we have incorporated the same strategy into a more extensive portfolio comprising 30 ETFs.

The performance has shown a significant improvement, jumping from a 5% compound annual growth rate (CAGR) to 17%. One of the primary contributors to this boost is the trade frequency. While trading a lone ETF (GDX only) resulted in 456 trades over the specified period, expanding the universe to 30 ETFs increased the trade frequency to 2480 trades during the same timeframe.

In summary, keep a look out for various ideas – they can present themselves anywhere. Take those ideas and test them using rigorous methods, as covered in the Trading System Mentor Course.