Escape The Volatility

Escape The Volatility. Have you ever felt punch drunk on your investing journey? You know, that sensation of being emotionally drained, bewildered, or disoriented, like the aftermath of taking repeated hits to the head from Mr. Market.

Uncomfortable feelings often arise in investing, and they usually come in two forms. The first is a dip in your equity, known as a drawdown. The second arises from the swings in your portfolio’s value, which we call volatility.

Volatility

Volatility measures how much a portfolio’s value fluctuates over a specific period, say, a year. Think of it as resembling the ups and downs of a roller coaster that gives your stomach a curious feeling. Some portfolio values experience significant changes, while others remain steadier, akin to a serene ride.

High annualized volatility indicates that an investment’s value is quite erratic—think of a roller coaster in full swing. Low annualized volatility signifies milder value shifts, resembling a gentle merry-go-round.

Investors use volatility to gauge an investment’s risk level—whether it’s like a roller coaster (higher risk) or a merry-go-round (lower risk). Riskier investments might yield more profit but can also lead to jittery nerves due to substantial drops. Conversely, safer investments might offer lesser returns but boast predictability without shocking surprises.

Hence, annualized volatility assists you in understanding whether an investment’s ride in a year will be a bumpy or smooth one.

The perfect investment would ideally yield an acceptable return with minimal volatility.

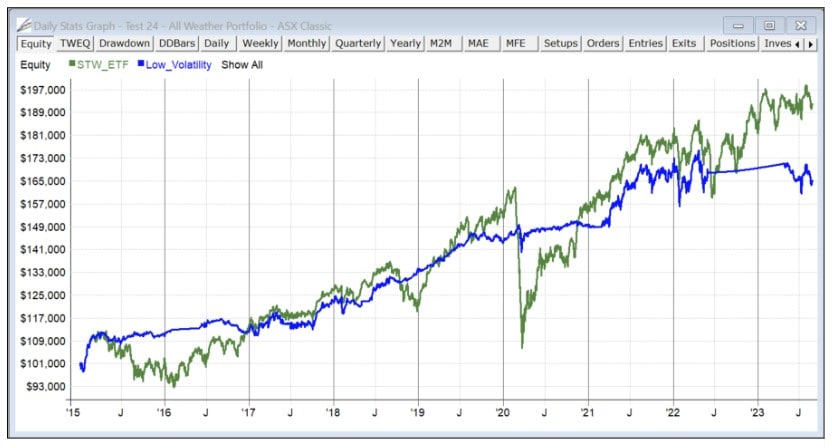

Consider a Buy & Hold strategy with the SPDR ASX-200 ETF (STW) as a benchmark. Since 2015, it has generated an annual return of +7.7%, with a drawdown of -34.9%. The annualized volatility stands at 15.8%. These figures are quite normal for a higher growth investment.

Now, let’s explore a similar approach to see if we can maintain a comparable return while reducing both drawdown and volatility. We’ll stick with the SPDR ASX-200 ETF (STW) and introduce the SPDR Australian Bond Fund ETF (BOND). Every month, we’ll gauge the momentum of both and allocate 100% of funds to the one with the highest momentum. If either exhibits negative momentum, we’ll hold onto cash.

Here’s what the equity growth looks like.

In this scenario, the portfolio’s return stands at +6%. However, the drawdown has significantly improved, decreasing from -34.9% to a much more reassuring -9.8%. Additionally, the portfolio’s volatility has been cut in half, dropping from 15.8% to a mere 7.4%.

If the idea of having a less volatile portfolio captures your attention, feel free to hit reply and share your insights.

If you’d like to learn more about systematic trading, consider our Beginner’s Course or view our turnkey code offerings.