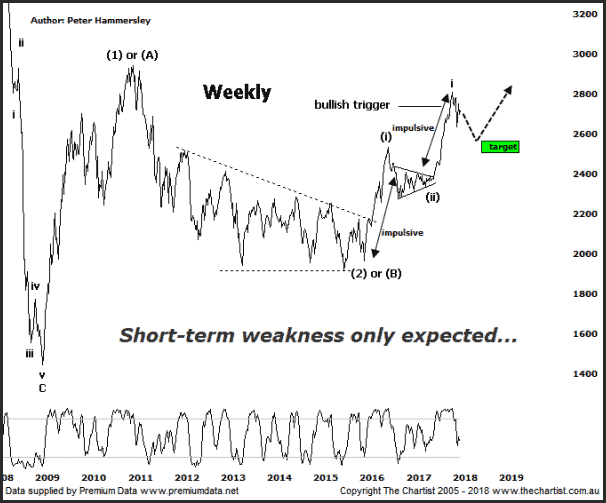

Mortgage Stress Continues to Bubble

Experts have been calling for the housing bubble to burst in Australia for many years now. Yet prices have continued to head north. The rate of annual increases has moved at an even faster pace over the past few years. However towards the end of 2017 and 2018 thus far, there are indicators surfacing that […]

Read more