Outlook for Australian Small Caps

Peter Hammersley, author of the ASX Chart Research service has some positive words about the Small Cap end of the Australian market:

It’s a well known fact that when confidence is high and global equity markets are trending nicely, investors and traders are inclined to take on more risk.

This is called “risk on”.

Where do these investors go?

Toward small cap stocks.

Whilst the smaller end has severely underperformed from the 2009 lows there are many reasons to be cautiously optimistic longer term:

- Technically impulsive price action has developed.

- The “risk on” approach has returned.

- Outperforming the larger cap stocks over recent months.

- Price is holding above a zone of support

- Further stimulus out of China, should be bullish for Australian equities.

- Whilst traders are continuing to chase yield a healthier looking market would increase confidence levels.

- The beaten down small caps offer an alternative.

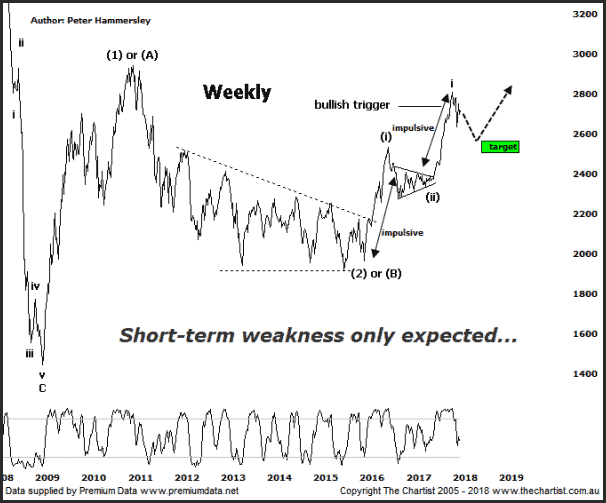

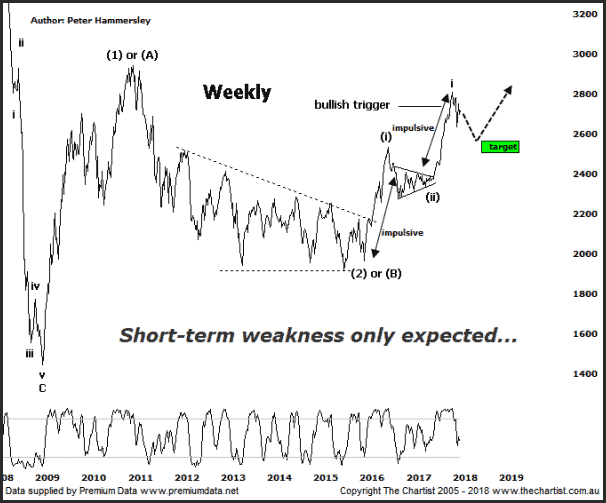

Taking a look at the weekly chart (below) it’s easy to identify the impulsive price action off the 2015 lows.

This came after several frustrating years for trend traders due to the choppy sideways activity. However, sideways range trading is almost always followed by potent trends. By all accounts what we’ve seen so far is just the beginning.

There is near term scope for a minor dip. A shallow dip will be considered constructive for an upside expansion of the current trend, possibly to 3500 in this current wave.