What Should I Do If I Miss A Signal?

A common question we get when trading longer term momentum style strategies, such as the Growth Portfolio, is how to manage a missed signal.

Do we chase it?

Do we stand down and wait for the next signal?

Do we buy it if it’s below the original entry?

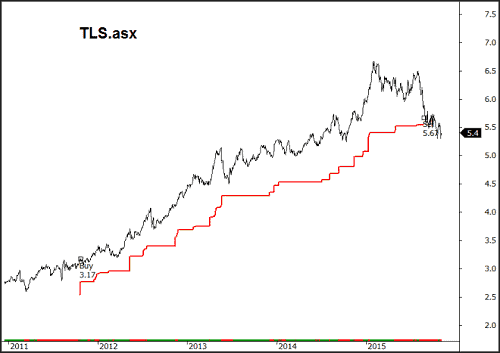

It’s an important question because in a strongly trending market a position may remain open for extended periods and not allow a secondary entry from the system itself. A recent example is the trend in Telstra (TLS) that was caught in late 2011 and ridden through mid-2015. With the addition of dividends, this was a quality trade that worthy of catching, but without a secondary entry trigger some way to hop on the ride is needed.

So here’s how to do it yet remain within the bounds of the strategy design of buying strength.

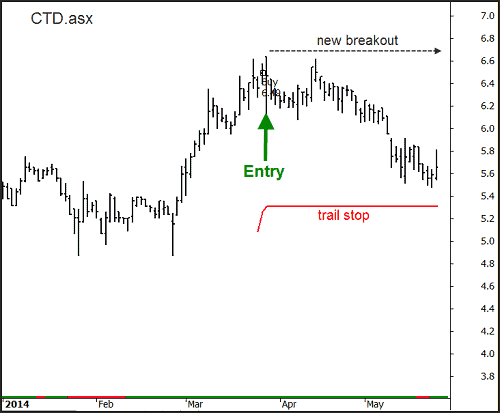

Consider the following chart of Corporate Travel (CTD) that triggered a buy signal in March 2014 at the $6.50 level.

Prices traded sideways for a week before starting to decline. Some may have seen this decline as an opportunity; after all, the price is better now than at the initial entry. This is logical thinking – it stems from our desire to purchase something cheaper than what we could have previously.

The issue with trading is that we need to sell the instrument at some stage for a profit. Remembering that price persistence is a core trait of markets (momentum), we’re not to know at this point whether the small decline is the start of something more sinister, or just a dip in the larger ongoing trend.

In order to remain aligned with the goals of the strategy, and stay aligned with the longer term trend, then we need to wait for price strength to reassert itself, meaning we should be buying strength, not weakness (obviously if the strategy is built to buy weakness, then that’s okay).

With the CTD example above we need to define a level at which we can suggest upward momentum has returned and ensure bullish probabilities are back in our favour. That level would be a move above the prior high which, in this case, is $6.70.

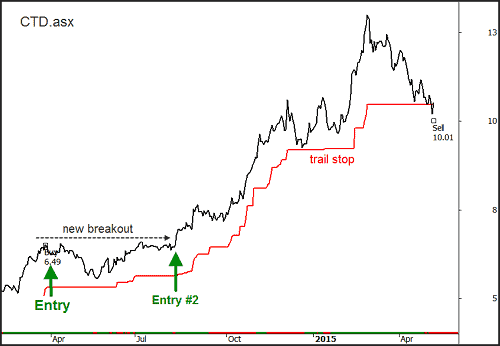

The next chart shows how that new entry level took shape.

So if the initial trigger was missed, then a trader could join the trade late so long as upward price persistence has returned, as per Entry #2 above. If price had continued to decline then no trade would have taken place.