Trading Setbacks – Financial Markets

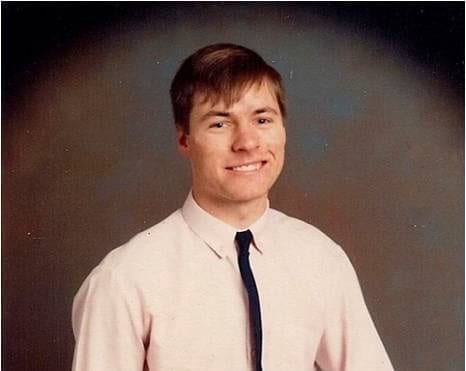

Nick Radge has ridden many waves of the financial markets since placing his first trade in 1985. With 30 years of skin in the game, Nick Radge will share some of the crucial lessons that have allowed him to not only survive, but consistently profit along the way.

In 1985 you started trading your own personal account, how did that go? Was it a case of beginner’s luck, or was there some early setbacks, and expensive lessons?

Back in 1985, it was very different to the way we trade today. Obviously we didn’t have the internet back then. We didn’t have the courses and seminars and books and trading magazines, the data, software and all the paraphernalia that is available today. Back then, the only way you could get a real trading book was to request a catalogue from the US, which would take three weeks to get to you, and then when it arrived it was a little black and white catalogue of books. You’d send off your order and six or eight weeks later a book would turn up in the mail. Now we have information at the touch of a button which can be both a blessing and a curse. It’s easy to have information overload.

So what were some trading setbacks? When I started I had no idea what I was doing. I had no money management, nothing. All I had was a five and ten day moving average crossover, and a bull market. And that’s where the luck came from. My early setback was when I became greedy. Back in those days you had a two week settlement period if you bought a share. You didn’t have to give anybody any money for two weeks. And of course the share market could moved a long way in two weeks.

So we discovered a loophole and started trading in and around this loophole; we traded but didn’t have to pay for the shares for two weeks. And after you make a little bit of money, it seems like you’re making money for free, so you trade bigger, and bigger, and bigger.

And then the 1987 stock market hit.

So I learned a very, very expensive lesson early on. I was young and stupid, greedy and ignorant. I learnt a couple of valuable lessons; only trade what you can afford to lose and respect your capital.