Stock Splits – To Buy or Not?

Some large corporate activity has been taking place with Apple announcing a 4-for-1 stock split on July 31st, and Tesla announcing a 5-for-1 split this week. Both stocks powered higher on the news.

So what is a stock split and does it induce buying?

Stock splits are a way for a company to increase the number of shares outstanding while lowering the share price. They tend to be neutral events for investors. For example, say a company has a 2-for-1 split, for every share you own you receive an extra one – but the share price will halve so the net effect is, theoretically, zero.

Companies will tend split their shares if prices get extremely high and therefore the lower price makes it more accessible for smaller investors.

There are several ‘market structure’ reasons for splitting, such as reducing the bid/offer spread, or fine tuning compensation arrangements if staff are paid in stock or stock options.

But by and large, a company as popular as Apple probably wants more people involved as investors. They don’t just want someone to buy their product. They want those customers to buy into the company. And to do that they need the price to be at a level at which the average investor feels they can invest.

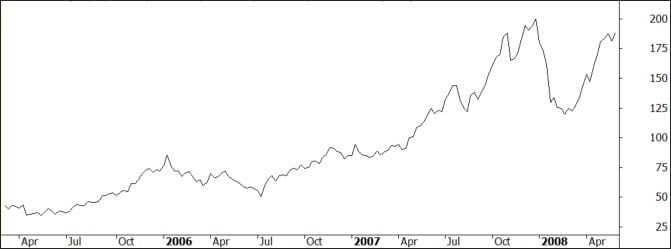

Below is the price action immediately following the Apple 2-for-1 split back in 2005.

Prior to the split the share price had risen very fast from $30 to $90 in a matter of months. After the split, the price barely dipped from the $45 split level before going back to $200.

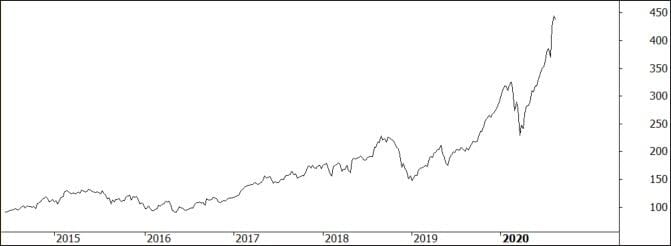

The next chart shows the price action of Apple immediately after the 7-for-1 split in 2014.

Leading into the announcement the stock had been trading at $650 and afterwards it allowed investors to buy in sub-$100. Again, the stock barely dipped afterwards and has since proceeded to travel to $450.

Technically there is no reason for a stock to split then trade higher. The company fundamentals have not changed and the bullish/bearish drivers have not changed. However, studies have shown that stocks that have split have gone on to outpace the broader market in the year following the split and subsequent few years.

So what should we expect for these two upcoming splits?

The millennial Robinhood traders love the products of both Apple and Tesla. Indeed, Robinhood has 600,000 clients holding Apple and they (currently) think that stocks just go up forever, especially these two.

BTFD!* is the millennial trading motto…and now they’re getting the mother of all dips.