Rookie Mistakes Made by Amateur Traders

“Your mind will do everything it can to make you hold a bad position yet entice you to exit a perfectly good position.”

Our behavioural biases haunt us during times of heightened volatility such as we’re seeing now. Fear. Greed. Hope. It’s when we question everything we do and come up with excuses or change plans to placate our grievances.

One change of tactic I see a lot of is known as ‘style drift’.

The most common type of style drift is when an active investor fails to exit a position when required and decides the position will become a longer term buy and hold telling them self “it’s a good quality company offering a solid yield so it’ll come good.”

Maybe. But what if it doesn’t? HIH was a damn fine company to many, as was Babcock & Brown. Neither ended well.

I have no issues with strategic buy and hold positions, indeed Trish and I have some ourselves. The issue comes from justifying a bad position by hiding it in the hope it will come good.

If you want to buy good quality companies that offer solid yield and long term growth, by all means do so. But here’s a REAL plan:

Allocate a portion of your total portfolio to each strategy, then apply and stay within those boundaries.

Example: You may be 7-years from retirement and decide to allocate 60% to passive income producing stocks. You also want a little more bang for buck so you allocate 30% to a more active strategy such as the Growth Portfolio. And with the last 10% you have a dabble in your favourite FX market.

When an exit signal is generated within the Growth Portfolio strategy, you take it as designed. The position doesn’t ‘drift’ into another part of the portfolio.

You have a strategy and a plan for a reason: to achieve your investment goals. Stick to your plan and follow the rules.

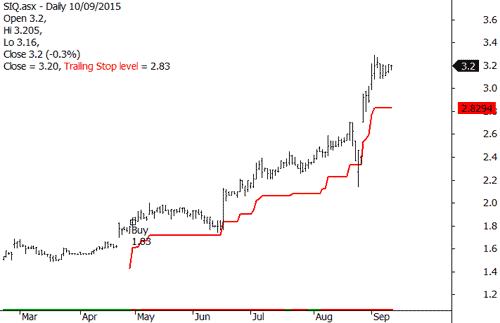

This is the trade you want: SIQ

We bought SIQ in May 2015 in the Growth Portfolio and continue to monitor the stock for Members (as at 15 Setp 2015). We will advise them when it’s time to sell. That’s the beauty of our strategies; we tell you what to buy, how many stocks to buy, when to sell and how to manage the trade along the way.

Why not test what The Chartist can do for you? Take a 2-week trial membership for only $19. which will give you access to all strategies and analysis including the Chart Research and Growth Portfolio.