Managing Larger Portfolios

For the last 20-years I have run my main trend following portfolio with 20 equal positions, each with 5% capital.

Most assume 20 is a nice round number, but in fact the efficient frontier for portfolio diversification is 18 positions. Rather than explain that to clients, and to make life easier, I simply rounded it to 20.

I recently received an interesting question from a client. Rob expressed concerns about getting fills as his portfolio had grown to a point that liquidity started to become an issue.

There are a few solutions to this, but let’s start with Rob’s initial query.

He asked what the returns looked like when the number of positions increased, to either 30 or 40.

To answer that we’ll test the idea on the Weekend Trend Trader strategy, traded on the ASX using the default parameters. Commissions and dividends have been included as have delisted stocks via Norgate Data.

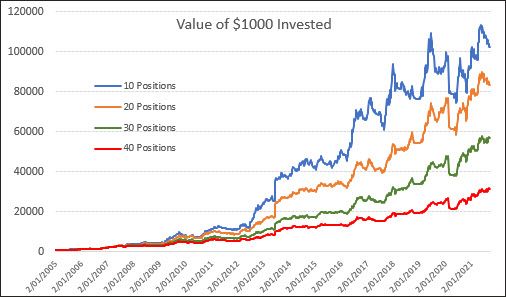

The chart below shows the equity growth using 10, 20, 30 and 40 positions.

The higher the concentration of positions, the higher the return. However, that comes at a cost; portfolio volatility.

So what’s a good trade-off?

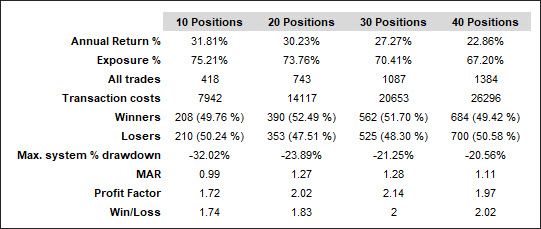

The table below shows a summary of various performance metrics. The MAR ratio measures the growth rate divided by the maximum drawdown (deepest equity decline). Essentially it’s measuring the risk-adjusted return, meaning the higher the number, the better the performance.

The 30 position portfolio offers a compounded growth rate of 27.27% with a maximum drawdown of -21.25%. That drawdown tends to be a maximum level for most retail investors. So Rob could increase his portfolio to 30 positions to help alleviate some of the liquidity issues without giving away too much of the return.

However, there are two other ways to deploy capital when liquidity becomes an issue. The following are suggestions that I personally use.

The first is useful when trading longer-term trend or momentum strategies. Being longer-term in nature, slippage is not a large drag on performance. If we’re holding positions for many months, and looking to capture big moves, then paying a few extra cents here and there isn’t costly.

So, partial positions can be bought during the course of the day without too much disturbance to liquidity. This is also more practical these days with flat fee brokers such as Self Wealth ($9.50 flat fee regardless of trade size. Use this affiliate link to receive your first 5 trades free).

The second is allocating funds across a variety of different strategies and markets. Obviously this increases diversification, but also allows funds to be distributed more broadly. I discuss strategy diversification in more depth HERE.