Making Watchlists Work For You

How can you use our free watchlist service, Trade Long Term, to spot opportunities?

It’s important to state that these watchlists are not signals. Instead they provide a short list of high momentum stocks that are potentially continuing with strong trends or pulling out of basing patterns and beginning new trends higher.

Here’s a few examples from a Momo-50 List.

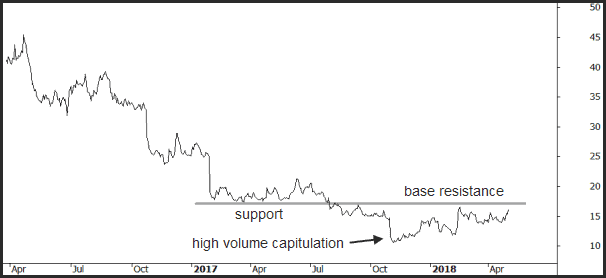

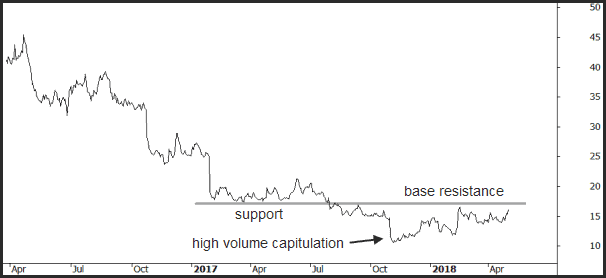

Under Armour (UA) showed up at #7 on this week’s list. It provides a classic example of a basing pattern which tend to turn into a new trend higher.

The stock has been in a steady downtrend since mid-2015 when it traded above $55 a share. After finding support during early 2017 near $17, long term investors finally had enough and capitulated leading to a 23.7% decline on October 31st. A low volume retest occurred in early 2018 suggesting sellers had dried up and now opens the way to breaking higher. As at writing, the stock is testing the old 2017 support which has now become a clear line of resistance in 2018.

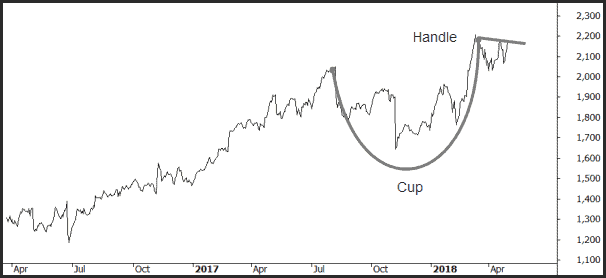

The next example, Booking Holdings (BKNG), is #17 on this week’s Momo-50 List. Unlike Under Armour above, this stock is just 2.2% away from it’s 52-week high suggesting not only strong momentum, but also a high probability of continuing.

The pattern showing here is a Cup & Handle, one of the most popular technical setups in the US. It’s the prime entry method in the bestselling book How To Make Money In Stocks by William O’Neil.

As its name implies, there are two parts to the pattern: the cup and the handle. The cup forms after an advance and looks like a bowl or rounding bottom. As the cup is completed, a trading range develops on the right-hand side and the handle is formed. A subsequent breakout from the handle’s trading range signals a continuation of the prior advance.

You can register for our free watchlists at Trade Long Term.

The watchlists track the top S&P 500 stocks and sectors and incorporate a proprietary ranking method to maximise market momentum and catch the market leaders before they move. They’re also the basis of my aggressive momentum strategy for the US. Access is via free registration – no credit card required.