Investment Case Study: Building On The Weakest Link

Travis W. lives in Louisville Kentucky. He’s a busy Dad of two young boys with a demanding job as a domestic pilot for UPS. About 4-years ago he read Meb Faber’s paper on the Ivy Portfolio which led him down the path of momentum investing.

Over the next few years Travis invested several hundred hours of individual study and testing before live trading an options strategy designed to make him a steady return during sideways markets. He also has invested some assets with professional commodity funds (CTAs) which tend to perform well during sustained bear markets.

However he felt his weakest link in the portfolio was exposure to stocks in a strong bull market. His performance goal for such a strategy was to produce returns exceeding 20% p.a. and be willing to accept higher risks to do so.

Challenges

As a trained pilot Travis relies heavily on systems and evidence. He wanted the same rigorous processes with his investments. Whilst well read on technical analysis he had no programming experience. In order to design, build and test a systematic momentum style strategy he needed to up-skill to become a proficient programmer. Not only would this support his immediate goal but would enable him to develop additional strategies to diversify his portfolio as his net worth increased.

A second challenge was having an intimate knowledge of the systems he traded to have the confidence to follow it during live trading and difficult periods.

Solution

The Trading System Mentor Course is a natural connection between theory and real world implementation. The course was developed specifically for investors like Travis. People that want to become completely independent, build trading strategies from the ground up to suit their own beliefs and achieve their own objectives, and importantly, truly understand how and why their strategy worked in the real world.

Under the watchful eye of two mentors the 6-month course is divided into two sections. The first 3-months are dedicated to learning programming. The latter 3-months are hands-on design, build and testing followed by real world implementation.

Results

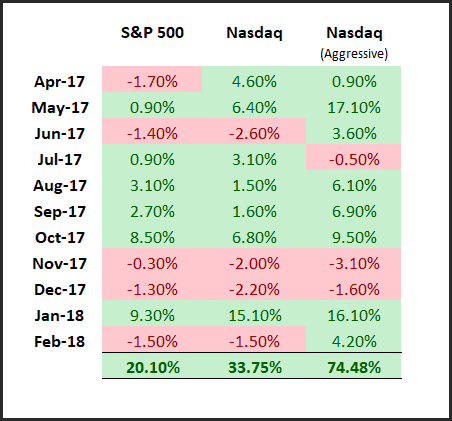

Travis joined the Trading System Mentor Course in February 2017 and has been blessed with some outstanding market conditions. Even so, one year on he’s ticked all his boxes; learned coding, programmed three momentum strategies and has them running real time alongside his other investments.

Here’s how they’ve performed^:

Here’s a final word from Travis:

It’s been a great run for momentum systems. More importantly to me is that I have some systems that I’m comfortable sticking with long term. I am sure the downturn will come eventually. I’m just happy to no longer stress about how I will manage the downturn. I think I’ve heard this phrase from someone on here: “Next 1000 trades!”

P.S. The Trading System Mentor Course is currently open to new students. If you’re committed to becoming a better systems trader and learning new skills join us now. If you don’t think you are ready to take this step, then perhaps our Beginners Guide To Building Trading Systems might be for you.