Don’t Bet on a Reversal of 2017 Gains

The US S&P 500 delivered its 9th straight year of gains.

Only once since 1928 have we seen 9 winning years in a row – that was 1991 through 1998 at the height of the Tech boom.

And we all know what followed…

Would it be prudent to suggest after a great year a poor year is surely to follow?

90-years of evidence suggests otherwise.

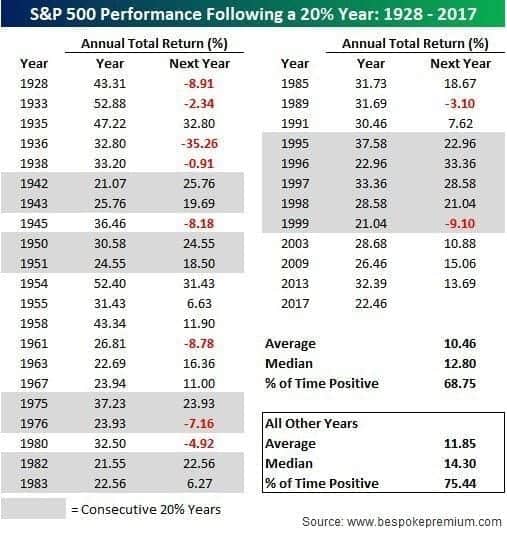

The following research by Bespoke Premium shows since 1928 there have been 32 occasions where the S&P 500 has risen by 20% or more.

The table below shows these years and the return the following year.

In the year that followed each ‘big’ year (let’s call it the subsequent year), the index saw an average gain of 10.46% with positive returns just over two-thirds of the time.

What is surprising is that the subsequent years are only modestly below the average (11.85%) and median (14.30%) total returns of the S&P 500 following years where the index was not up 20% or more.

In summary, probability suggests 2018 will be another positive year.

Of course, we could be wrong.

But consider this: there have been five periods where a 20%+ year was followed by another 20%+ year.

And with tax cuts starting to flow through, now is not the time to be in cash. Trish and I recently doubled our allocation to our US trend strategies.

Want to get involved and follow along? Contact us and ask me how.