Current Research Project

With almost complete automation in my trading, and when not fishing, I spend considerable time researching the myriad of ideas that constantly pop into my head.

The latest is trend following with options as a part of the Trade Long Term Premium Portfolio.

Leverage aside, in theory options would allow lower capitalised traders to access higher priced stocks. The lowest stock price currently in the Premium Portfolio is trading at $242. The highest is just shy of $2000.

You get my drift.

However, options are multi dimensional. Unlike shares, which just go up or down, options have other attributes that must be thought through and accounted for.

Thankfully with an evidence based approach such as the Premium Portfolio we can look at the historical data to help guide us.

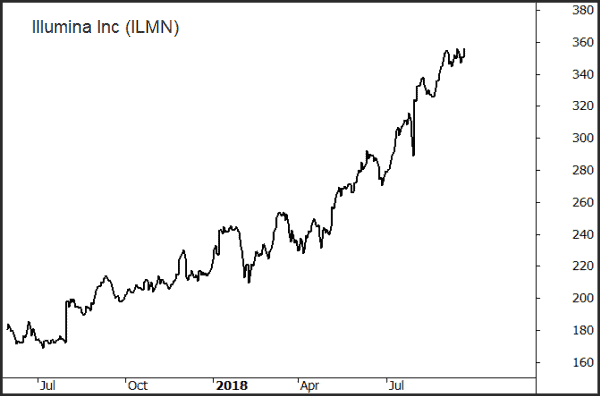

Let’s use a current example to discuss. The following is the trend in Illumina Inc (ILMN) which we’re currently riding.

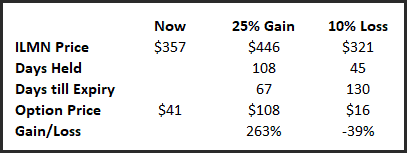

The first consideration is that options decay over time, so if holding a longer term position we need to ensure time decay is at a minimum. With our extensive research data we know the Premium Portfolio has an average hold time for winning trades of 108 days, and losing trades 45 days.

Therefore, we need to select an option that has at least 6 months to run. ILMN has a March 2019 expiry which is 175 days away. Ideally we’d like to be out of the position with more than 3-months left till expiry to minimize that time decay.

Next we need to choose the strike. This is important as well because careful selection can help maximise the risk/reward. Out-of-the-money strikes tend to lure most novice traders because the premium is cheap, meaning they can gain added leverage, and also because if the position moves in their favour the upside gains are extremely large.

However, out-the-money-options have no intrinsic value which means the premium price you’re paying is only time decay. If the share price doesn’t move you will lose the entire amount and as time goes on that loss accelerates.

The better choice is to select a slightly in-the-money-option. If the share price doesn’t move, or even declines slightly, the loss will be somewhat lower.

For our ILMN example, the current share price is $357. The $340 call is trading at $41 so we have about $17 intrinsic value and $24 time value. If prices stall, and assuming we hold to expiry, we’d still have an option worth $17 rather than zero. Also consider that if the share price stalls the strategy will most likely rotate out of ILMN and into another name.

This also highlights the benefit of buying the option at $41 (1 option = 100 shares) rather than the shares at $357. Exposure to 100 shares will cost $4100 rather than $35700.

The average gain for the portfolio is 25% with an average hold time of 108 days. The average loss is just short of 10% and is held for 45 days. Knowing this allows us to get an understanding of the option valuations should the position move for or against us.

**Important note – we’re using averages only. Individual positions will vary. We’ve also used the same volatility readings. In the real world volatility will change and impact us either positively or negatively.

The following table shows the option gain or loss based on these estimates.

In a future article we’ll discuss appropriate position sizing for trading a trend strategy using options.

Learn more about Trade Long Term here.