Strategy Diversification, Not Just Market Diversification

Strategy diversification is something I practise. I don’t just diversify markets, I diversify strategies within markets.

Several months ago I appeared on Better System Trader LIVE discussing the merits of diversification across different strategies.

Most traders are tempted to jump ship and look for something better when a period of strategy under-performance occurs. Invariably that new strategy will run the same course and it becomes a case of chasing one’s tail.

My view is that investors need to accept every strategy will have times of under-performance and that it’s impossible to ‘time’ or predict when the good performance is just around the corner.

Therefore one is better off using a suite of strategies to diversify – the same as a financial planner building a portfolio of shares and bonds.

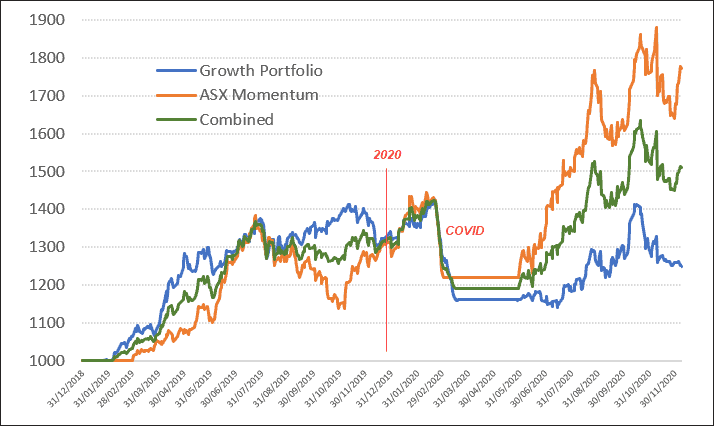

2020 is a great case in point. Below are the equity curves for two strategies I trade and that are available to members of The Chartist.

Equity Curves

As can be seen, both the Growth Portfolio and ASX Momentum Portfolio arrived at the same point of equity growth at the start of 2020. The latter had a bumpier ride but got there in the end.

2020 has been a different story. It’s clear the Growth Portfolio, a strategy I have been trading for over 20-years, has found the going tough.

The Growth Portfolio Results

Why did the Growth Portfolio struggle? The main reason is how it enters and exits positions. Being an absolute trend following strategy, it moves in and out of positions slowly, whereas the ASX Momentum is either fully invested, or fully in cash.

When markets started taking off in June, the ASX Momentum went all in. The Growth Portfolio however has struggled to get involved – indeed, even now I’m only 60% invested.

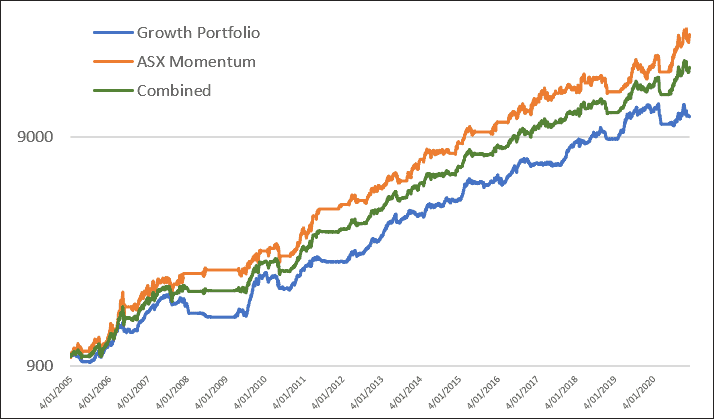

Below is the long term view of equity growth. Both strategies show steady growth and play a solid defence when required. Importantly both significantly outperform Buy and Hold.

Long term view of equity growth

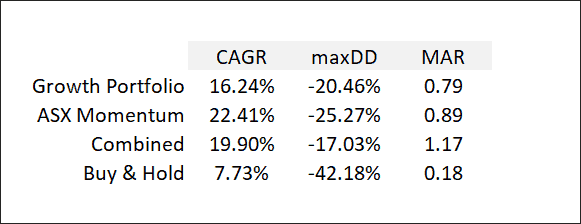

Whilst the ASX Momentum has the stronger return, it also comes with a steeper drawdown.

As I’ve always said, the return is negligible if you can’t handle the drawdown.

When the two strategies are combined, the risk-adjusted return becomes extremely favourable.

So rather than dump a poorly performing strategy, focus on the long term potential and add a secondary strategy to help weather the short term ups and downs.

The number and types of strategies to use will depend on available capital, time and experience. The above example shows a very simple solution, but one could take it further and add US-domiciled portfolios and even short duration strategies.