What’s In a Universe?

We tend to look at ‘the stockmarket’ as one large universe of constituents. Whilst that is true, what many fail to see is that it actually contains numerous sub-universes that, in and of themselves, move to different beats.

For example, in recent times the NASDAQ has been the dominant force. I remember back in 2014/15 in Australia, the Small Caps far outperformed the Large Caps, yet in 2017 it was the Large Caps that outperformed the Small Caps.

The usual game is to attempt to predict which part of the market will outperform in future – a feat which I believe is impossible. Rather, why not trade a strategy on the different parts of the market?

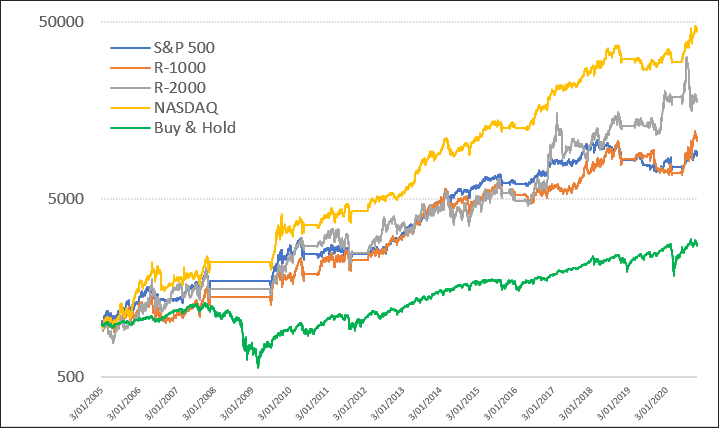

For a broad overview we tested the Large Cap Momentum turnkey strategy on four different universes using the exact same parameters^.

Whilst each universe has beat Buy & Hold it’s obvious the NASDAQ is the standout and followed closely by the, albeit more volatile, Small Cap Russell-2000.

But will Tech continue to lead the way into the future? Possibly.

That said, I’ve also found that certain strategies ‘tend’ to operate better in certain parts of the market as well. For example, absolute trend following tends to show better risk adjusted returns in Smaller Caps. Relative momentum strategies, such as shown above, tend to offer better risk adjusted returns in Larger Caps.

That said, are we ‘curve fitting’ with the benefit of hindsight? Quite possibly.

In the next article we’ll take the research further and see if we can’t improve the risk/adjusted returns of the above by allocating to two or more parts of the market using the same strategy.

I’ll also answer the obvious question; why not just trade the same strategy across every stock?