Evolving With The Market

A hot topic of discussion lately has been changes in market environments and their impact on investment strategies, especially regarding interest rates and inflation. Today, I thought I’d take a look at this problem from a data-driven perspective.

It’s no secret that, when left unaltered, the performance of a trading strategy will deteriorate over time. The example most often given is the Turtle Trading strategy, which took a group of laymen to trading success overnight by following its simple rules. Forty years later, following the turtle rules exactly will quickly see your capital squandered.

So, what causes such a turnaround of fortunes for a strategy? The market changes. Whether from economic conditions, market participant behaviour, or technological advancements, the market is always shifting and evolving.

The trading systems we create are models designed based on historical data to best predict an outcome from unseen future data. But this future data is never the same as previous data and will generally move further and further away from historical data as time progresses. This problem is known as data drift and is the force that will slowly diminish the edge of a trading strategy if left unchecked.

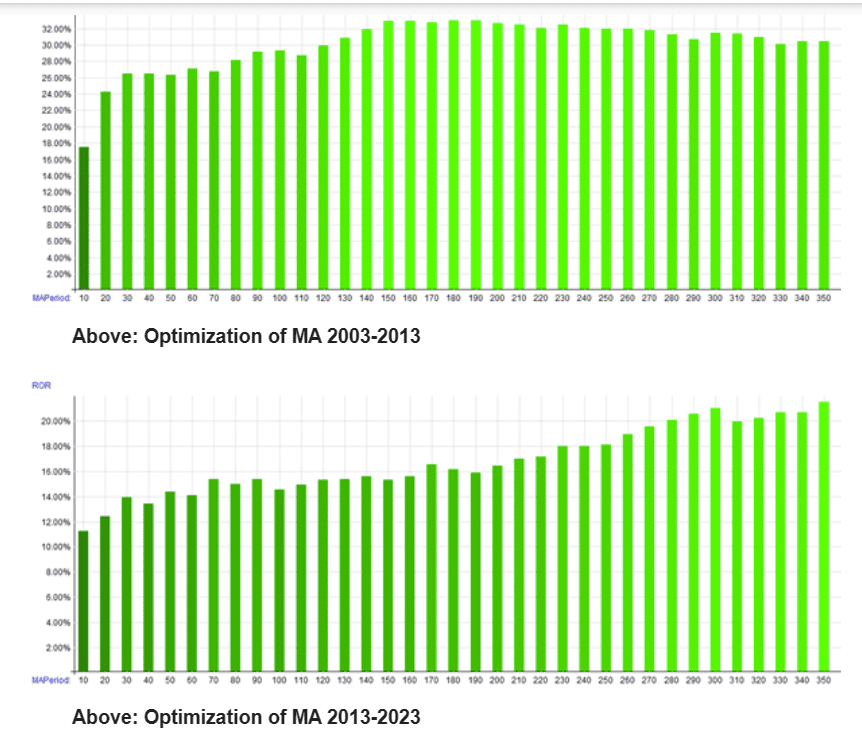

Take the two charts from our Day Trade Long strategy below. I’ve optimised the moving average period that defines an uptrend in individual stocks across two separate decades. The first chart shows 2003–2013; the second chart shows 2013–2023.

Day Trade Long strategy

What we can see is that the model performs significantly better on a longer moving average lookback for the latter decade. The input data has drifted to the right. Furthermore, we can see that every option is still profitable, so the overarching concept still holds weight.

Obviously, this is a simple experiment; we’re looking at one of many variables and its impact on a single statistic. But we can clearly see how the variable impacts the performance of the entire system if left unchanged.

If you’d like to learn more about developing and running robust trading strategies, consider our Beginner’s Guide To Building Trading Systems.