Allocating Funds Across Strategies

Allocating Funds Across Strategies brings up many questions.

Reader question from Thom M.

If I allocate 60% of my portfolio to systematic trading, how do I decide how much of it should go towards one or the other strategy to achieve the perfect balance?

Great question and there are a few answers to consider. Firstly let’s look at it from a high level.

I’m a big believer in having several strategies. Not every strategy will work all of the time so having two or more can offer some diversification. This goes hand-in-hand with Signal Luck which I have recently discussed. Ideally the styles should be different and, if possible, the target markets should be different.

Whilst I personally trade numerous strategies, the amount you trade will be dependent on capital, time and capabilities.

For simplicity I will outline the logic for my retirement account, which by nature is limited in what it can and can’t do. My goals are simple:

- Beat buy and hold

- Stay on the right side of the market

- Be defensive in sustained bear markets

- Minimise workload

Up until recently I had almost 100% of the account allocated to a single trend following strategy, the Growth Portfolio . Due to the size of that account and with consideration of being overly reliant on a single strategy I have also added the Weekend Trend Trader (WTT) strategy to the mix.

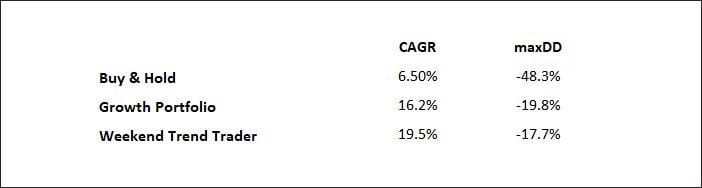

The WTT was released in 2012 and built for the US market, however, I’ll be trading it on the Australian market. Here’s how the two strategies^ stand up:

So the question is how much to allocate to each and is there an optimal amount?

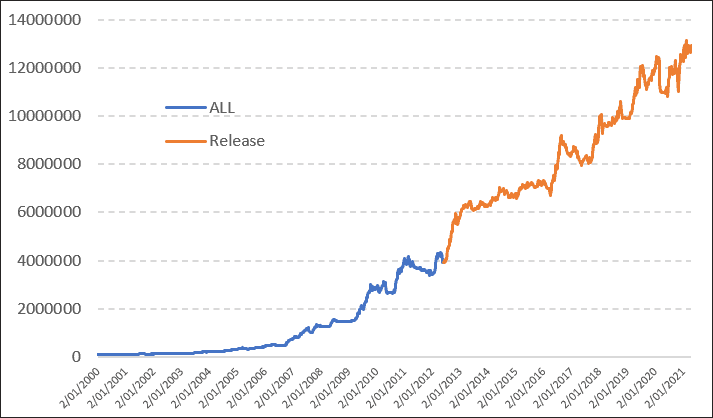

Using a handy tool built by Cesar Alveraz we’re able to get some insights. The Multiple Strategies Backtest and Optimisation Tool allows us to add numerous strategies together and then optimise the allocations and re-balancing periods. The optimisation allows you to search for various combinations, including the maximum return, best risk adjusted return or minimum drawdown. (Edit: We now use RealTest for all our testing and strategy design, this allows us to combine multiple systems into 1 portfolio.)

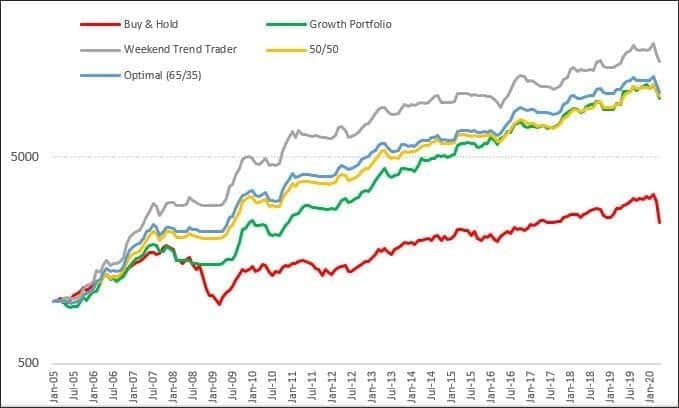

Here’s how the various portfolios look:

The maximum return combination would be allocating 100% to the Weekend Trend Trader strategy – but that defeats the purpose of diversifying the signals.

The optimal allocation was 65% to the Weekend Trend Trader and 35% to the Growth Portfolio. The combination returned a 16.9% CAGR with a -16% maxDD.

But interestingly, the lowest drawdown combination was exactly a 50/50 split. This results in a CAGR of 16.4% and a maxDD of -12.8%.