Trade Management With An Index Filter

Last article we discussed the importance of aligning oneself with the short term trend when swing trading. This time we’re going to look at how that same short term trend filter can improve trade management. Before we jump in it’s imperative to mention the importance of exits and why they tend to be the determinant of profits, rather than the entries.

It’s no secret that new and amateur traders strive for the perfect entry. There’s a common fallacy that to be successful in trading we need to select the right stock, sector, market or the right trade. The focus is on being right. As such trade selection or stock selection becomes the goal, as opposed to making money.

On a side note I recently witnessed a fellow trend-follower being rebuffed by a value investor who not-so-eloquently stated that, “…risk management was a cop out“. In other words, he believes we should pick the “right stock” and that there is something wrong with relying on risk management to generate profits.

The goal for both of us is to make money. End of story.

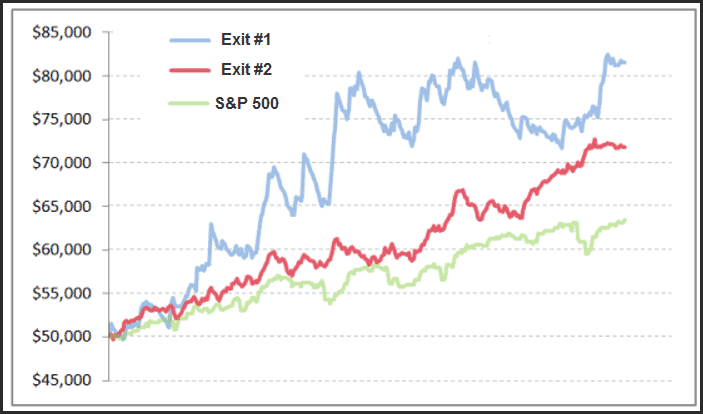

Back to the importance of exits. To highlight the inconsistency of attempting to select a better entry, here are two equity curves that both use the same entry setup, the same entry point and the same position sizing. They’ve both made 300-odd trades and both paid $2000 in commissions. The only difference is the exit used:

Several points of interest; firstly, Exit #1 has made 46% more profit than Exit #2 (63.1% vs. 43.5%). The win/loss ratio of Exit #1 is 2.5x that of Exit #2 (2.54 vs. 1.04). These are both very promising data points, and for the average trader wanting to make as much money as possible, they’d be inclined to use Exit #1. But the story changes somewhat when we dig beyond net profits and into the actual journey travelled to make those profits (a topic that long time readers of my material will be well versed in).

It’s quite obvious that Exit #1 is more volatile than #2 – the equity jumps around like a roller coaster, whereas #2 shows a much smoother ascent. Secondly the win rate of Exit #1 is just 35%, in other words 2/3rds of all trades are losers. Experience suggests that once the percentage of winning trades drops below 45% the task of following the system becomes mentally more difficult. We can measure the ‘difficulty of execution’ using Profit Factor, which for #1 is 1.38 and considered quite low. Exit #2 on the other hand has a win rate of 61% and a Profit Factor of 1.61 making it more comfortable to actually trade.

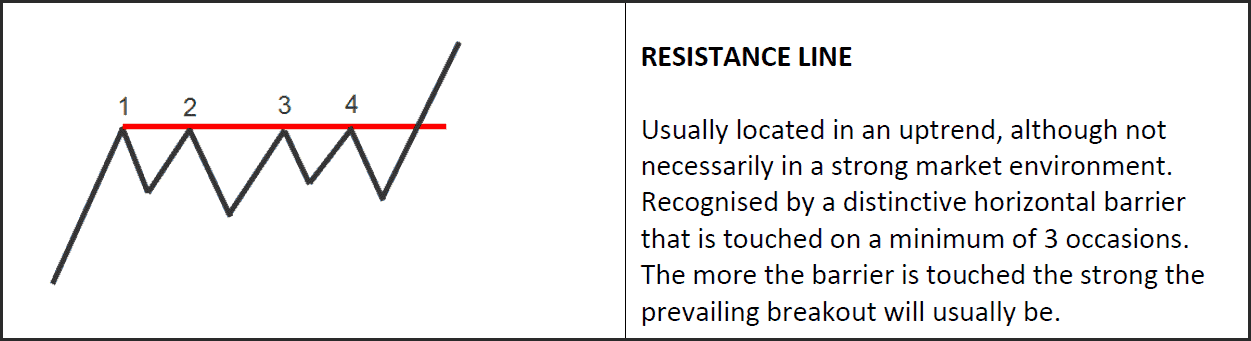

Let’s move to the Index Filter that we discussed last article and how it can be used to manage our trades. As an example we’ll use a Resistance Line setup straight out of our Playbook:

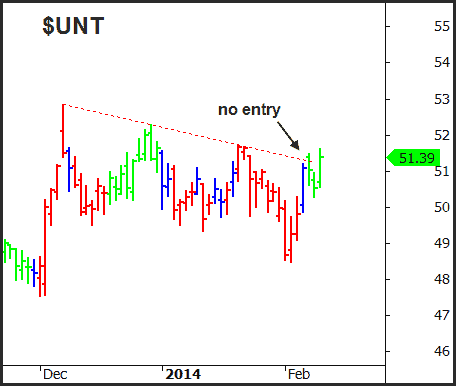

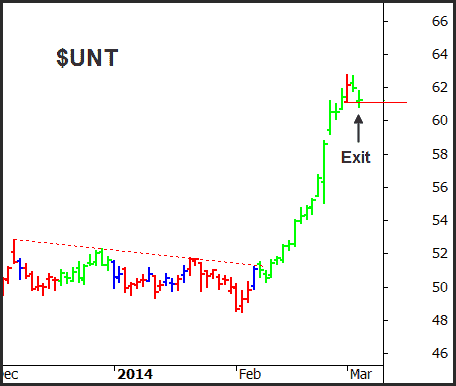

The following chart shows Unit Corp ($UNT) and a 3 point resistance line break. The initial break was not valid because our Trend Filter was still in the blue “Neutral” state. We would therefore enter on the next move higher when the Trend Filter was in the green “Bullish” state which occurred on Feb 11th.

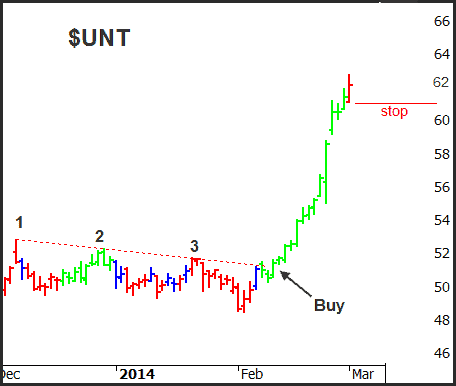

The next chart shows how $UNT pushed higher over the coming weeks aligned with the trend of the S&P 500 (all green bars). Then, on March 3rd, the S&P 500 signalled a trend reversal from Bullish to Bearish, although it’s not often we see a complete trend flip like this. Normally we’d see the blue Neutral come into play which allows a softer stop adjustment, such as a channel or count-back method.

With the trend of the S&P now deemed Bearish we need to be more assertive with the trade management as probabilities suggest stocks will also retreat. I’m never one to completely close the door on a trade, meaning exiting just for the sake of exiting. I prefer that stocks ‘take me out’ by confirming price action. So when the trend of the S&P 500 turns down and flashes a red bar, we will adjust the stop aggressively – right up and below the low of that day. If prices continue lower we’ll be taken out of the trade and lock in the profit, but should prices buck the trend of the broader market we’ll at least be able to stay on the ride without giving too much back.

Notice in the final chart that even though the Trend Filter flipped back to green, we did actually get taken out of the position on penetration of the low.

There could be some discretionary rules added to say that should the Trend Filter move back to the Bullish green state that we revert back to a standard trailing stop, but that would involve moving the stop loss backward – which is something we never want to do.

Remember, our minds think and act differently when we have a position is on, so it’s imperative to stick with the rules throughout the process. We can always look back and assess past trade performance in order to make future adjustments, but not during a trade.