Survivorship Bias

The Double 7’s Strategy article proved to be a very popular topic – thanks for all the feedback. In the article I stated, “…we’ll use historical constituents to remove survivorship bias” and this has created a few questions, namely what the heck does it mean?

According to Wikipedia, “Survivorship Bias is the logical error of concentrating on the people or things that “survived” some process and inadvertently overlooking those that did not because of their lack of visibility. This can lead to false conclusions…”

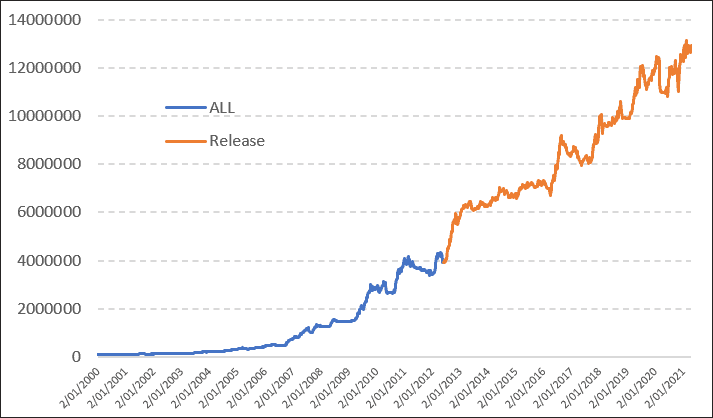

When it comes to the stockmarket, investing and systematic trading, Survivorship Bias is not only prolific, but can greatly exaggerate reality going forward. The following chart shows the rise and fall of Regis Resources (RRL), a current member of the ASX-100.

Now let’s assume you’ve designed a trend following trading strategy that trades just the ASX-100. You run your strategy today and see that RRL has made some huge profits due to the 2000% share price rise between 2009 and 2013.

Now the issue here is that RRL only became a member of the ASX-100 in April 2012, so back in 2009 when it started it’s massive rise, it wouldn’t have been a contender for your strategy because it wasn’t a member of the ASX-100. As a result, the data generated by your simulations today has over-estimated the return because it’s included RRL for that period when it shouldn’t have.

That is survivorship bias.

So what impact on the Double 7’s strategy? In our article we tested the strategy using historical constituents meaning that a signal was only taken if the stock was a member of the ASX-100 at the time of the signal. Those simulations, being accurate because Survivorship Bias had been removed, showed a return of 15.65% per annum. However, if we run the same simulation yet use only the current members of the ASX-100, meaning we introduce Survivorship Bias, the return jumps to 18.9% a figure that is incorrect and unrepeatable.

*Note: We use and recommend the Norgate Data which allows the removal of Survivorship bias.