Trailing Stops for Short Term Trading

Trailing stop losses are a valuable tool when short term trading using technical analysis. Once a breakeven stop is reached, the trailing stop helps lock in profits as the trade progresses. The trailing stop removes angst and decision making during the trade as it provides a definitive answer as to when to close a position. They can be part of a computerised trading system to trigger exits or as part of a discretionary trader’s arsenal.

As with profit targets, the exit criteria is known and planned for before the trade is initiated. The exact level at which the trailing stop triggers is not known, but the conditions which are to trigger an exit certainly are. Such stops can be left in the market so they are triggered on an intraday basis for the end of day trader, negating the need to constantly watch the market, and allow the user to let profits run and cut losses short.

Common trailing stops include percentage based moves, average true range (ATR) stops or moving averages. This article is not a definitive document on trailing stops but rather just outlining two trailing stops that the short term trader may find useful or get the creative juices flowing. Bear in mind that there is no perfect stop. The key is to find one that works well most of the time. Furthermore, certain market conditions may demand that profit targets are used as well as/or instead of, a trailing stop.

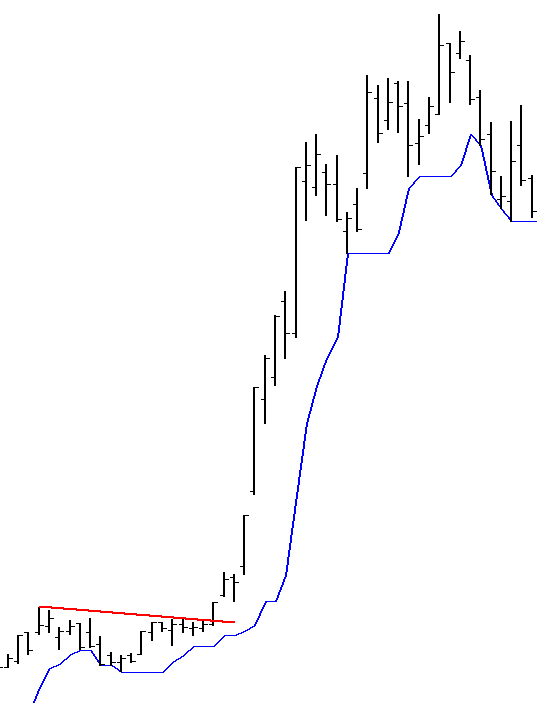

Channel Stop

The Channel Stop is in essence, a breakout stop. Often used as a breakout entry mechanism, it is also used as a trailing stop. For a long trailing stop example it is calculated as the lowest low of x periods minus one tick. The trade is stopped out intraday when price breaks the low of the set amount of periods. This chart shows a five bar channel stop that has kept the trader in a parabolic move to realise a far greater risk/reward than a profit target would have provided.

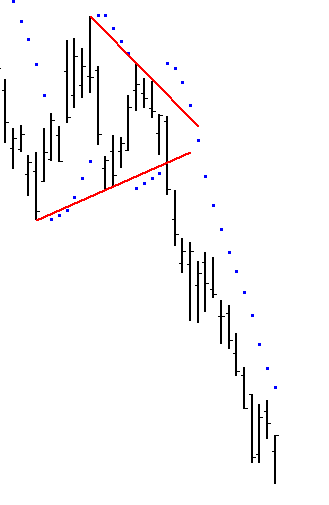

SAR Parabolic

The SAR Parabolic is included in most stock market trading software packages. It has two variables; the acceleration factor and the maximum acceleration. In Amibroker the standard settings are 0.02 and 0.2 respectively. However, if we tinker with the acceleration factor and change that to 0.04, we find that in many instances this will tighten the stop up and exit the trade earlier and at a more profitable level. Of course, the opposite can also occur where the tighter stop exits the trade which keeps progressing. Which you prefer will be determined by your objectives. I find the tighter settings work quite well for short trades which can reverse in a hurry. As seen below on this breakout trade that remains open, it trails a tight stop which starts to contract and tighten as price begins to consolidate and potentially reverse.

Short term trading requires active trade management specifically to minimize losses and allow profits to run. A short term trader can place a trade with a trailing stop and know that, should the market turn, they will be stopped out as opposed to riding the stock down. A trailing stop is an important factor in a short term trader’s trade management arsenal.