K.I.S.S. Trend Following – Part 1

Trend Following

Note: Be aware what I propose here is not a complete system – far from it. The goal is to provide a starting point from which to undertake further research and evaluation.

With regard to trend following, one of the most frequent queries I receive is, “Where do I start?”

Here’s the thing; don’t overthink this stuff.

The very basic, simplistic and foundational start point for any trend following strategy is to limit losses and ride winners.

Limit losses using a breakout with a low risk entry.

Ride winners using a trailing stop.

Here’s some basic steps how to start toward a full trend following strategy.

Let’s start with the entry, specifically a breakout with a low risk entry. Almost every software package comes with a Parabolic SaR indicator. You can read more about it HERE, suffice to say we’re only interested in the SaR for finding low risk entries.

* SaR = Stop and Reverse

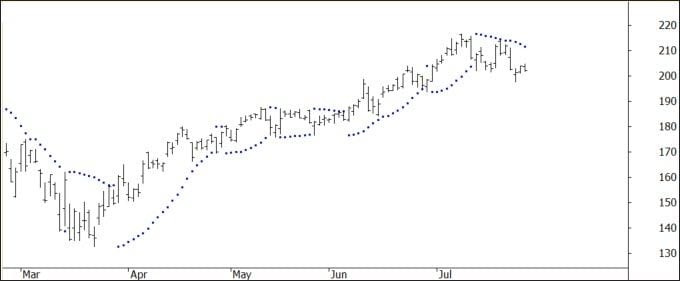

The following chart shows the Parabolic SaR flipping back and forth.

We can see that it catches a lot of the noise. The trend higher has been relatively stable yet the SaR gets chopped around a lot, so as a stand-alone trend strategy it’s not going to be overly effective.

But here’s the important aspect; we’re able to define the difference between a low risk entry and one that is not necessarily low risk. The following chart shows where the SaR flips between long and short.

Notice that the width (entry minus initial stop) at “A” is considerably wider than those setups at “B”.

This means that an entry at A has 3x the risk as an entry at any of the B points, which in turn means the position size at B could have been 3x as large as that of A.

A larger position equals a bigger bang for your buck with the same risk.

We could quantify this better using a percentage – similar to what I described in this article, specifically…

“My small amount of ‘colour’ back then was to only take trades when the initial risk, defined as entry minus stop loss, was less than 3% of my capital. If it was higher than 3% I skipped the trade.“

So we could add an additional rule that we only take an entry where the setup was less than say 5%. That would invalidate an entry at A yet allow an entry at any of the B points.

And yes, there are many other ways to come to the same conclusion, i.e. using a 50-day breakout with an ATR initial stop or similar. What I like about the SaR is that it allows you to catch a breakout before prices hit a specific high point that is traditionally associated with a breakout.

In the next article we’ll look at the second part of the trend following equation, ‘riding the winners’. And later, how to find candidates that have potential to show trend persistence.