Trading Short with Meme Stocks

We’ve discussed Meme stocks previously.

This week, NEGG decided to join the party. On June 30 the stock jumped 78%. A few days later it jumped 41% at which point it became a stock of interest for short selling. The following day it rocketed 148%. Here’s the chart…

That’s a 560% gain in a 6-days.

Great if you’re on the right side of it. Not so much if you run a short side system.

The question is whether or not we’re in some ‘new normal’ with these meme-style stocks and secondly, how do we deal with it if trading short-side strategies?

I can assure you it only takes one of these to rattle your bones. And having a few in a row can completely destroy built up equity.

To assess the new normal I ran a basic experiment using a short side day trade strategy. It looks for heavily over extended stocks, then attempts to short sell them the next day if they continue to move higher. Once shorted, the stock is exited at the end of the day.

This test uses such a system, selects a maximum of 10 positions and allocates 10% of equity to each.

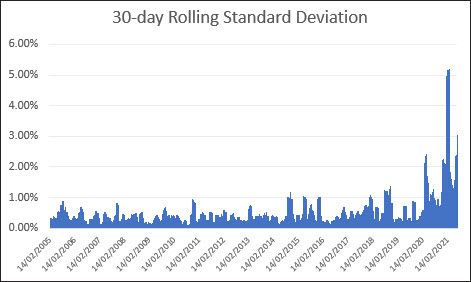

However, what we’ll do here is measure the rolling 30-day standard deviation of the system’s daily return.

As can be seen, from 2005 through to the start of 2020, the strategy’s equity volatility was reasonably stable. The normal oscillations based on regular market volatility can be seen.

We then get the first major deviation with the serious COVID sell-off in March 2020. Considering that sell-off was equivalent to the 1987 crash, that jump in equity volatility is explainable and would be expected.

And then everything goes a little pear-shaped. There is a consistent 3x to 5x jump in volatility from mid-2020 onward.

This appears to be the Meme stock anomaly and clearly will have a large impact on trading short side strategies if it’s here to stay.

How to tackle it?

I don’t have a solid solution, but here’s a few immediate thoughts…

If the identification of a Meme stock could be done accurately, we could remove them from the tradable universe, although a purist would deem that data mining. But NEGG wasn’t really a pure Meme stock and the initial advance was actually fundamentally driven. In theory a Meme stock could come out of nowhere meaning removing them is going to be hit and miss.

The next alternate is to avoid stocks with high short interest as these are the ones ‘more likely’ to be targeted for short squeezes. One could build in a short interest ratio or similar formula as a way of standing aside from those stocks that could be prone to a short squeeze.

Another suggestion is to lower exposure to strategy such as allocating 50% less capital to it.

If this Meme anomaly is here to stay, then trading on the short side is going to be a very bumpy ride for many.