Trading Capital: Think Outcome Before Input

Trading capital: how much money do I need to start trading?

We hear that some 95% of traders fail. Whether that’s true or not I don’t know, but it is recognised that the vast majority of new traders fail. The ‘why’ is probably for a number of reasons, including lack of strategy, lack of discipline and patience.

But in my view a core ingredient is wanting to be a ‘type’ of trader without recognising what is required to mathematically gain an edge. I’m not talking discipline and patience or lack of strategy, because even with these traits a trader can still fail.

I’m talking about a lack of trading capital and the impact of commissions being a secondary consideration to the ‘type’ of trader one wants to be. In other words many people come to trading with illusions of grandeur, excitement and the thrill of the game so they naturally gravitate to shorter-term trading. Short term trading also adds to the ‘instant gratification’ mentality that is prevalent in society today.

There is nothing inherently wrong with short term trading, but it does lend itself to high turnover, usually 200 trades per year. 200 trades per year chews up a lot of commission which in turn creates drag on your account. Add to this dilemma that most new traders come into the game with limited capital and they almost guarantee failure before they even begin.

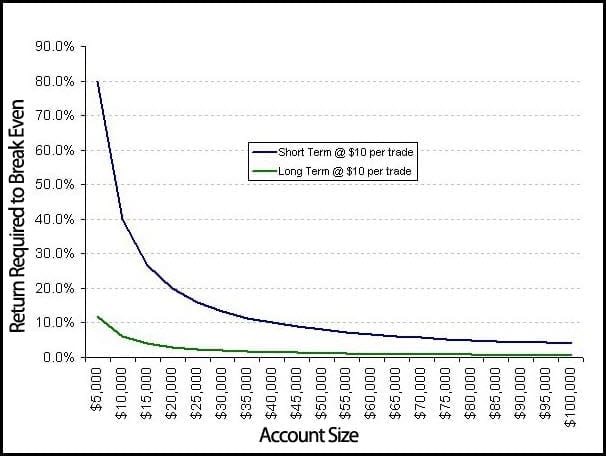

The following chart shows the required gain to simply breakeven. The x-axis is various account sizes and the y-axis is the required return to breakeven. We are assuming a short term trader does 200 trades per year at $10 commission and a longer term trader does 30 trades a year at the same rate.

Not only is there a significant gap between the two, but the majority of that gap occurs between $5000 and $20,000, the account capitalization of most new traders. Even well capitalized traders come into the game using a lower amount of capital, “…I’ve got $X but I’ll just start with $Y in case I fail”. Needless to say they create their own failure by doing so.

Rather than thinking “what type of trader do I want to be?”, consider what capitalization you have to start with, what commissions your broker charges, and then decide what strategy would best fit. Use the chart above as a guide.

We use Australian broker SelfWealth for our long-term portfolios. They have a $9.50 flat commission fee per trade and are offering new accounts 10 free trades.