Three Strikes: What the Third U.S. Credit Downgrade Means for Investors

Just as the US stock market was passing back into positive territory for the year, it received a gut punch in the form of a credit rating downgrade from Moody’s, halting its roaring rally in its tracks. So, what is a credit rating, how have they affected markets in the past, and what can we expect from this most recent change?

What is a credit rating, and why does it matter?

A credit rating is an evaluation of an organisation’s ability and willingness to pay back its debts on time. A high credit rating means investing in the organisation’s debt comes with lower risk than those with a lower credit rating. In this case, the organisation is the US government, and the debt invested in is treasury bonds.

Investors purchase government debt by way of treasury bonds, essentially lending the government money, and in return receive reliable income via interest paid. Investing in US government bonds has long been seen as the lowest-risk way to invest because of the historical reliability of repayment. Theoretically, a downgraded credit rating could mean investors will be less likely to invest in US government bonds, potentially reducing the amount of money investors are willing to lend to the US government. As a result, the cost of borrowing for the US government would rise, as the interest payable (the yield) would need to increase to attract more investors. However, these are still early days, and people are still buying US Treasury bonds in the days since the downgrade.

Who decides the US government’s credit rating, and where do they all stand?

Credit ratings are determined by registered credit rating agencies (CRAs). The three major CRAs in the US are Standard and Poor’s (the company that maintains the S&P 500 index), Fitch Ratings, and Moody’s Investors Service. Moody’s is the last of the big three to downgrade their rating.

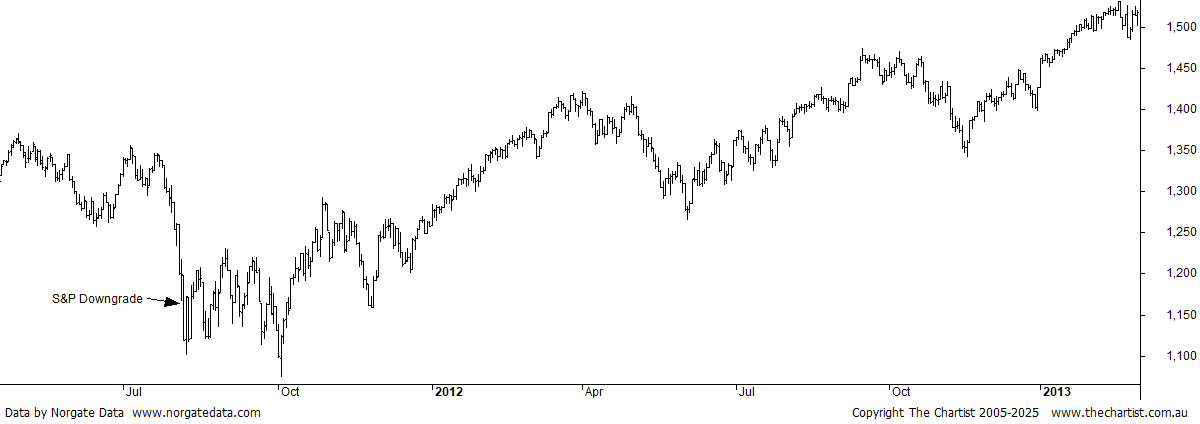

S&P was the first to downgrade their rating of the US government from AAA to AA+ on the 5th of August 2011. This was in response to what S&P called low “effectiveness, stability and predictability of American policymaking” following the 2011 US debt ceiling crisis, in which the US government came close to defaulting.

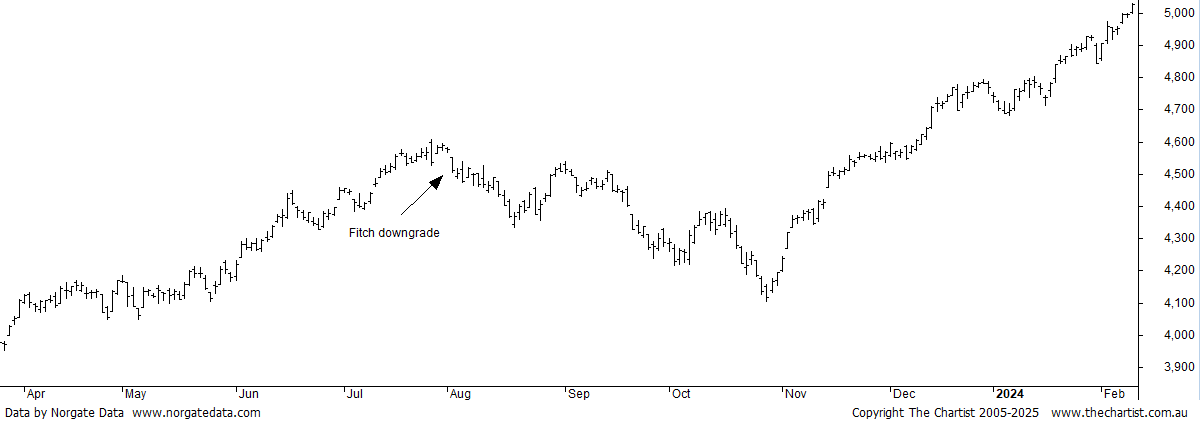

The next downgrade came from Fitch on the 1st of August 2023. In similar fashion to the S&P downgrade, Fitch was responding to the 2023 US debt ceiling crisis and what they called a “steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters.”

The final downgrade from Moody’s came last Friday, on the 16th of May, 2025. Moody’s reasoned that “Successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs.”

What happened after the first two credit rating downgrades?

The first downgrade was unsurprisingly the most shocking. With the US only just avoiding defaulting on their debts and the solution provided to this seen as inadequate by many, US stocks were already in strong decline. Following the downgrade, the slide accelerated quickly. On August 8, the first trading session after the downgrade, the S&P 500 fell -6.7%, while the Nasdaq-100 fell -6.1%. Amidst the uncertainty, stocks saw strong fluctuations across the rest of the year, not reaching pre-debt crisis highs until 2012.

Unlike the S&P downgrade, the market was not already falling when the Fitch downgrade was announced. The subsequent decline was therefore not as immediately steep. US stocks continued to fall until November that year, not recovering until December. The downgrade here wasn’t the only driver bringing the market down, but it did make people re-evaluate the possibility of recession.

The Moody downgrade: What can we expect?

All things considered; the Moody’s downgrade hasn’t told investors anything they didn’t already know. It’s been over a decade since S&P’s initial downgrade, and much of their criticism from that time remains intact. With all of this essentially ‘priced in’, the impact stemming directly from the Moody’s credit rating downgrade will likely be small.

The immediate reaction from the market to the Moody downgrade has been underwhelming; after the announcement, the S&P 500 lost -0.4% in the following session. However, an auction of 20-year bonds the day after that was met with little demand, driving bond yields up and the stock market down. Meanwhile, the price of gold and bitcoin rose as investors appeared to move capital elsewhere.

Further adding to the hesitancy towards US treasuries is President Trump’s newest “big, beautiful” tax bill, which includes a multitude of tax cuts. Tax cuts mean less income to pay off interest on the ballooning debt, with nothing being introduced to stop the growth of the debt. The result is investors expecting a higher return for the increased risk on their investment.

This move away from US treasuries also points again to the emerging “de-dollarization” of the global financial market, which I’ve mentioned a few times now, most recently in the article The Gold Rush: Safe Haven or Bubble? The increasing instability of US policy and markets has investors looking away from the US dollar towards global bond markets and alternate assets.

We could be in for some rough months ahead if nothing changes. However, the US remains the world’s foremost market, and we’re still very far away from that changing. As mentioned earlier, most of these factors have already been priced in by the bond market, and though yields rose, they have only done so to levels last seen in 2023.

As always, our approach is to invest in a diverse range of uncorrelated assets and trading strategies. You can view our various strategies on our 14 day Free Trial.