The Chartist Questions

This week I’ll continue to answer questions from @thechartist Twitter feed. If you missed Part-1, you can read that HERE.

Again, in no particular order or topic…

Q: Do you find it difficult to look at anything from a fundamental perspective (Strategic Portfolio) given the predominant mindset and approach has been technicals for so long now?My use of fundamentals is probably not what most envisage. I would suggest the positions in our Strategic Portfolio would be classified as ‘Thematic’ rather than Fundamental. And yes, I do look at the long-term charts but mainly for exits.

Q: What have been your most challenging / scary moments as a trader and what did you learn from it?Most challenging would be sustained drawdowns. I have managed those by adding different strategies in different markets and on different time frames. While this may not limit the duration of a specific drawdown, it defintely limits the depth.

Most scary would be the crash of 1987. I still feel concerned for a repeat of the 1987 event. March 2020 is the closest we’ve experienced to date.

Q: What are the 3 restaurants I should eat at in Noosa (for my July visit).Locale (on Hasting St)Rickys (definitely the best restaurant for lunch)Rock Salt (order the Duck)

Q: How do you robustly backtest your trading systems.All backtesting must start from a key idea. The key idea is your working hypothesis or your explanation of what the foundations of your system are and how it will work.

From there one needs to incorporate how the mathematical edge of the strategy is created. If you can’t explain ‘how’ the strategy generates a return, then more thought is needed before testing any rules.

Then we’d build the rules, and ideally the rules should be minimal in number and very general in nature. The more convoluted the rules, the less likely you’ll understand their robustness.

We only focus only on broad universes of stocks and not on individual markets or names. Single market systems are fraught with danger in my view – you can read an article about them HERE.

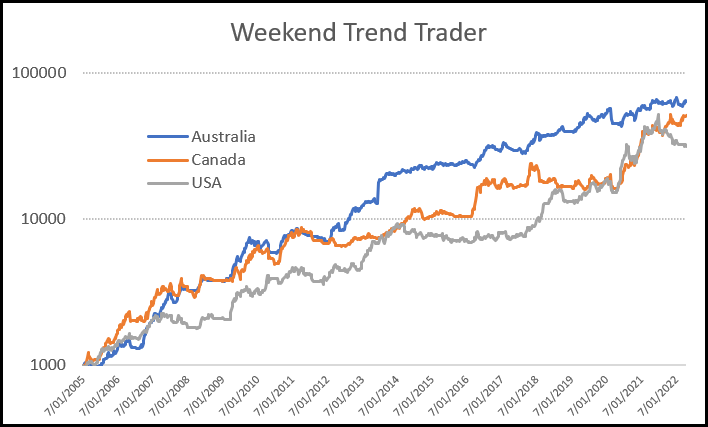

We’ll test a strategy on one set of data, such as the Russell-1000, then run it on an unseen set of data, such as the Russell-2000. Alternately, we could run the initial testing phase on one market, such as Australia, then run it on another unseen market, such as Canada.

A visual representation of robustness is shown with the following equity chart. This is the Weekend Trend Trader, a fully disclosed strategy that has been in the public arena since 2012. This performance is straight ‘out of the box’ using our turnkey code – no Radge tweaks or adjustments.

The takeaway here is not that the strategy works best in Australia, rather, it works ‘reasonably well’ on three different markets.

Consider this. The exact same rules have been used on every stock, all 25,315 of them.

That’s what robust means.

Q: What was an early “lightbulb” moment for you in trading, and does that insight still hold true today?This is an easy one. 1985. Looking at a 5 and 10-day moving average crossover chart and seeing the trends for the first time. Changed the direction of my life.

Q: GPS coordinates of 3 best fishing spots off Noosa!26.22.495’S – 153.8.489’E Sweetlip, Coral Trout, Tuskies, Spanish Mackeral26.15.996’S – 153.10.419’E Pearl Perch, Snapper, Tuskies26.18.940’s – 153.37.238’E Snapper grounds.

Q: What techniques do you use to eliminate “noise” and not get sucked in to making subjective overlay decisions that might compromise your strategies?I would suggest there are three important elements.

The first is a complete and thorough trust in my strategies. They have been rigourously tested over many decades of data and I have done a lot of work to ‘break them’. All I need to do is execute them over the longer term and ride the ups and downs.

Second, is the ability to remove my ego. That’s the ability to understand my strategy is better than me and that my own discretionary decisions are not robust. Also, remove my ego from competing against others. I’ll happily accept I’m not the most profitable trader to walk the earth but I don’t need to be. A simple proven process coupled with time, is the 8th wonder of the world.

Lastly, I have learnt to ignore the monetary side of the trading game. Obviously the irony is that we trade to make money, but the more focus you place on that money, especially as equity gyrates, the more difficult the end game becomes. Forget money. Focus on process.

Q: What’s your goals, legacy and favourite movie?Goal – To retire this year or next with Zach Radge taking a greater role in the business and for me to be his mentor. I won’t stop trading though.Legacy – I like micro philanthropy, specifically helping out local families/associations with direct funding that offer asymmetrical outcomes. Also, we’re tinkering with the idea of a trading school for young people aged 16 – 22.Favourite Movie – The Godfather