Risk Management Is A Cop Out…

“Risk management is a cop out…”

That’s a quote from a value investor aimed at technical traders, specifically trend followers. His logic goes something like this:

If you can’t pick good stocks then you’re basically an incompetent investor, or, if you can pick good stocks then you don’t need risk management. True? False? Or, who cares so long as you turn a profit?

I’m in the latter camp but (because the Boss says I can’t go fishing today) we’ll talk it through. First, let’s define what risk really is. When it comes to investing, risk has many faces, such as:

→ Market risk

→ Sector risk

→ Portfolio risk

→ Toxic position risk

→ Strategy risk

→ Liquidity risk, etc etc

But at the end of the day, these all point to one thing – capital risk, or the risk of losing an uncomfortable amount of your capital. After all, most stories coming out of the GFC were not about the risks listed above, but more so that people simply lost a boat load of money, and most people that throw in an investment tend to be influenced by the losses incurred. So loss of capital IS a key driver in investment decisions.

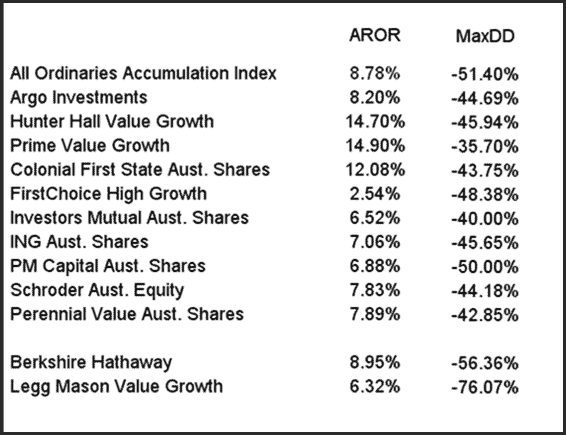

Capital risk is drawdown – the decline in your equity from a peak to a trough, and the largest decline in an investment is known as the Maximum Drawdown (MaxDD). The following table shows the annual rate of return (AROR) of some top Australian fund managers during the GFC and the capital losses their funds incurred.

When looking at risk and return together, the equation should be, “Are you willing to risk X% of capital to make Y% annual return?”

In the case of Argo Investments above the equation is, “Are you willing to risk 44.69% of your capital to make 8.2% annual return?”

Without doubt an interesting and somewhat uncomfortable question. It does suggest however that not much thought has gone into risk management as most managers are not much better than a buy and hold investor.

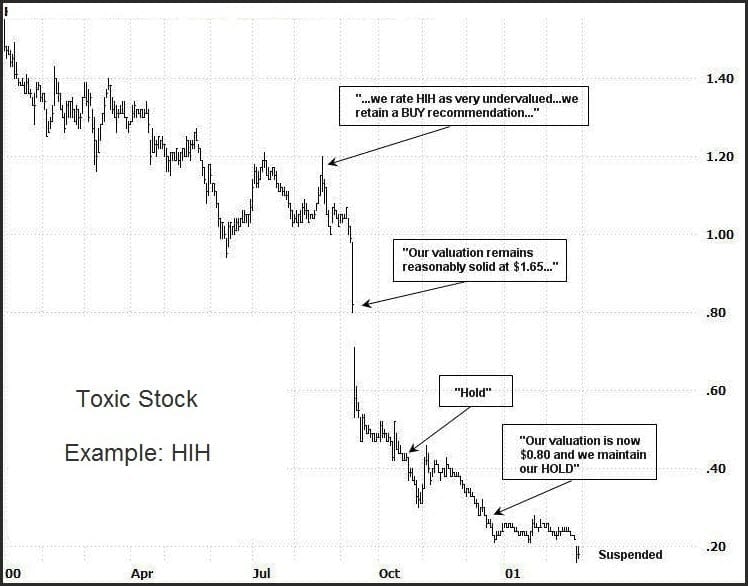

But there is more to it, as we’ll get too shortly. First however, let’s look at toxic position risk. Toxic position risk occurs when you fall in love with a position, a company or a story about a company. A little like love, the investor gets blinded and is unable to make a rational decision. Here’s a snippet of history showing a great example with the demise of HIH Insurance. The commentary is from the insurance analyst at JB Were back in 2000 who just couldn’t give up on it:

I think everyone has had one of these in their portfolio at some stage, but riding a loser into the ground, whether it be HIH, OneTel, Babcock & Brown, or even a Billabong, can do extensive damage to your portfolio.

Not being an expert stock picker I need to rely on a mathematical edge to generate profits. The easiest way, albeit not necessarily the most comfortable, is to be a trend follower. The simple philosophy is to cut losses and let profits run. Agreed – it’s not very edgy. Not very cool. And certainly doesn’t make a person look overly intelligent.

But it works.

So rather than focus on picking the next best thing, trend following works by maximising your wins when you win, and minimising your losses when you lose. Usually you’ll come out well ahead in the long run and you certainly won’t have a situation like HIH. Get out of bad positions quickly, take a small loss, then move on. Once you get a runner, then it’s a matter of staying with it and not being tempted to take a small profit to recover a set of prior small losses. Remember, you’ll never make a large profit by taking small profits.

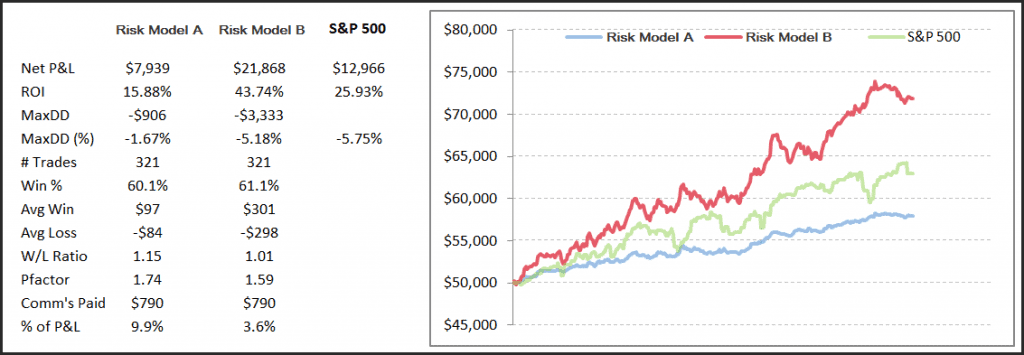

Risk management is also about increasing the effectiveness of your trading once you do have an edge. It’s about having optimal exposure to the market and to individual positions. Having a sub-optimal exposure will lead to dramatically reduced profitability, more so if you have a good edge. The following chart shows exactly the same trades using two different risk models. Next week we’ll discuss how you can operate at a more optimal level with your trading just like Risk Model B below:

Enjoy your weekend. I will be fishing.

Nick