Missed the Bounce? Here’s Why We’re Not Worried

It’s been a wild few months in the US stock market. By early April, the S&P 500 had declined -18% from the year’s opening. Things weren’t looking good. But, a month later, it rallied back to the year’s open level. The Nasdaq-100 has entered a technical bull market.

At the end of March, many of our subscription portfolios took a defensive position, reverting to cash and missing out on the sharp bounce back. So, were we too cautious? Have we missed out on this rally entirely?

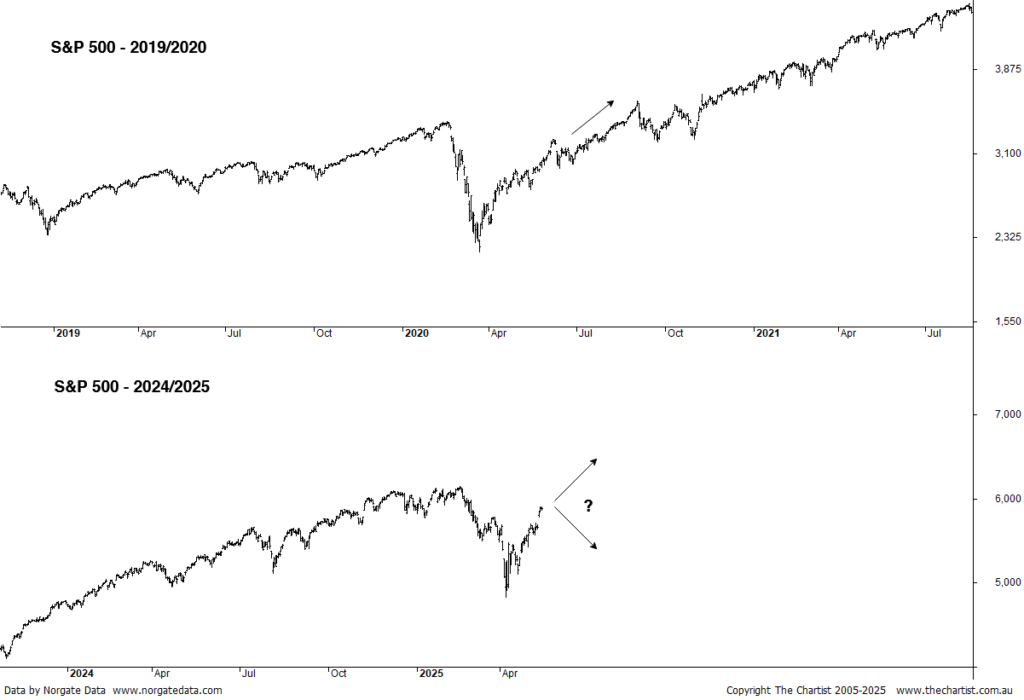

Well, obviously I can’t tell the future, but I can say we’ve been here before, and not that long ago either. In early 2020, as borders began to close from the Covid pandemic, the market tanked sharply. Our portfolios took a defensive stance, avoiding the worst of the damage. But similarly, the market bounced back quickly, forming a sharp V pattern. Looking at the two charts below, you can see a comparison between that 2020 dip and recovery compared to where we sit now.

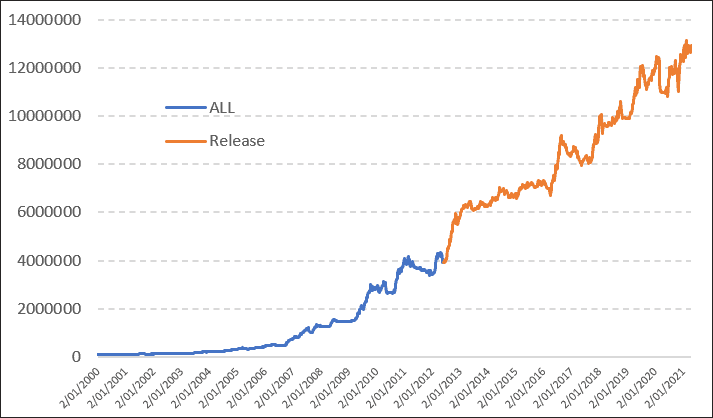

At that moment, as with now, it’s hard not to think, “If only I’d bought the bottom.” But of course, nobody knows with any certainty when the true bottom will occur, and many will suffer trying to find it. But regardless, we missed the initial recovery rally, so how did the rest of the year play out? Well, the market just kept going up:

2020 ended up being one of our best on record. The Trade Long Term and US Momentum portfolios, which were both entirely exited in April and May, gained 97.43% and 54.08%, respectively. Moreover, both portfolios were sitting at a loss prior to moving to cash in April. So, while we may not have been able to exploit the initial recovery bounce, there was no use crying over hypothetically spilt milk because the momentum remained.

Of course, there is no guarantee any pattern will play out the same way as it has prior, but the success of our past trading gives us confidence in our decision-making looking to the future. We’ve seen this story before and know there could be plenty of upside still to come. To view our portfolios and their past returns, why not take a 14 day free trial and start building the future you want.