How to control losses

How do you ensure that it is only a small amount of money you are going to lose? Have you got your stop losses in order before you enter the market?

Everything we do is planned in advance, and that planning comes in the format of some kind of a formula, or mathematical equation. So we might say something very simple like we’re going to buy stock XYZ. We will follow the ride so long as it moves up. But if the price turns down or against us by, say, 10%, then we will exist that position. So 10% loss sounds like a lot on an individual stock, but that’s why we buy a portfolio of stocks. So in reality, each time we have a loss it only represents half a percent, or maybe even 0.08% of loss of our trading capital. Therefore, all our losses are very, very small.

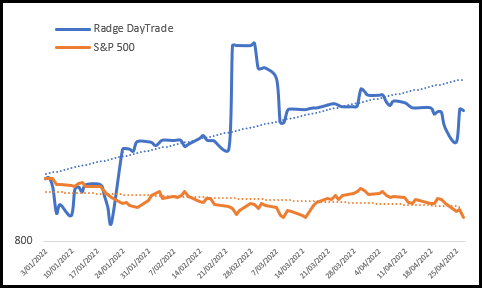

But if that stock keeps moving higher, we might make 10%, 20%, 30%, etc. Recently we exited a trade in the Commonwealth Bank where we finished up with an 87% profit. So the amount we win can be as much as four, five, or ten times as much as the risk on the trade. And so long as we keep doing that over the longer term we’ll always be ahead.

It’s all about winning more than you lose. The stop loss doesn’t have to be anything complex. I think people like make things complex, but it doesn’t have to be. The key here is to remain invested when the market is going up, and revert to cash when it’s going down. That’s a key component. Second of all making sure your profits far outweigh your losses over the longer term. That’s the bottom line. It doesn’t have to be any more complex than that.