Hedging Portfolio Exposure

Hedging Portfolio Exposure

A hedge is designed to protect a portfolio from adverse market movements.

Because I trade three long-only portfolios, I would want to protect from sudden and large downside shifts in the broader market. And all being active portfolios I’d only use the hedge whilst the positions remain open.

Common ways to hedge a portfolio include:

- exiting partial positions

- buying put options

- buying a reverse ETF

- initiating a collar with options

- shorting index futures

Be aware that some of these can be complex (collars), can be costly (puts), can deviate from the underlying benchmark (reverse ETFs) or provide excessive exposure (futures).

The selected hedge should be aligned with your knowledge and account size.

Also, be careful of the hedge morphing into its own trading system. I’m only interested in large moves. Attempting to iron out every crease will be a costly and frustrating exercise. I’m more inclined to let the cards fall where they may rather than hedge, but then again my (trading) psychological fortitude is a lot higher than most.

Nasdaq-100 Emini

Personally I prefer to use index futures, namely the Nasdaq-100 Emini for US portfolios and AUD futures for currency exposure. They are aligned with the portfolio holdings, easy to access via the same platform, and, being leveraged, are cheap to hold and trade.

To calculate the correct hedge I need to calculate the beta of the portfolio. Beta refers to the movement of the underlying shares compared to the underlying index – in this case, I will use Nasdaq-100 Emini futures as my base index. A stock with a beta of 1.0 will move up and down in sync with the index. A stock with a beta of 0.5 will move half the distance of the index and a 2.0 beta means a movement in the share price twice that of the index.

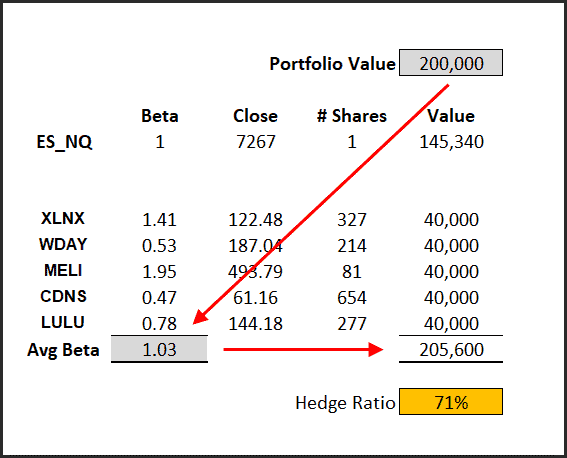

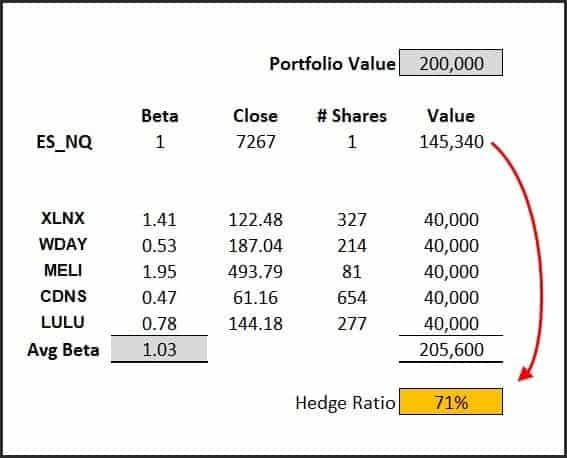

The following table assumes a portfolio value of $200,000.

I calculate the beta of each position against the index. In this example the average beta for the portfolio is 1.03, which is surprisingly low (last October the beta was closer to 1.6).

I then multiply the portfolio value by the beta. This is essentially saying that for every movement in the Nasdaq-100 futures the portfolio will, more or less, move the same amount.

Next we need to calculate how many index futures will be required to protect the portfolio. The following table highlights the underlying value of the Nasdaq-100 Emini contract. That value is $20 times the current price, which puts a single contract value at $145,340.

This is where it can be difficult for smaller accounts. If, for example, my portfolio value was $100,000, then using a single contract will overexpose me. The hedge will move more than what the portfolio will. That could be beneficial if the market collapses, but very expensive if the market moves higher.

Remember the goal of the hedge is not to make a profit; it’s to protect.

So in this example if I hedge using a single contract then I will protect about 71% of the value of the portfolio, and for the most part that’s enough. Many institutions hedge just 50%.

The next question is when to hedge? As stated above, as a general rule I’m wary of attempting to hedge against every downside blip, but obviously a downside blip can turn nasty very quickly.

Personally I’ve not (yet) found anything that I can systematically code up to automate the process. Using breadth on various time frames is showing promise – but more work needed.