All Weather: Allocation Not Timing

I thought this week I’d take a deeper dive into an intriguing question from Chartist member Peter, who asks the following question, specifically regarding the US All Weather’s (falling) bitcoin holding. Peter asks:

“Have you ever back-tested the implementation of an intra-month stop loss e.g. triggered by the breaking of a flat 200 day simple moving average (a significant signal of a change in long term trend)? It’s difficult to sit and hold the [bitcoin] position whilst it loses value every day that passes, waiting for the inevitable exit at month end.”

Thanks Peter, It’s absolutely a valid question, and one that we’ve definitely investigated in the past. So, let’s investigate this specific suggestion and then take a look at how the All Weather is set up to deal with this more broadly (and why I’m not worried).

The Baseline US All Weather

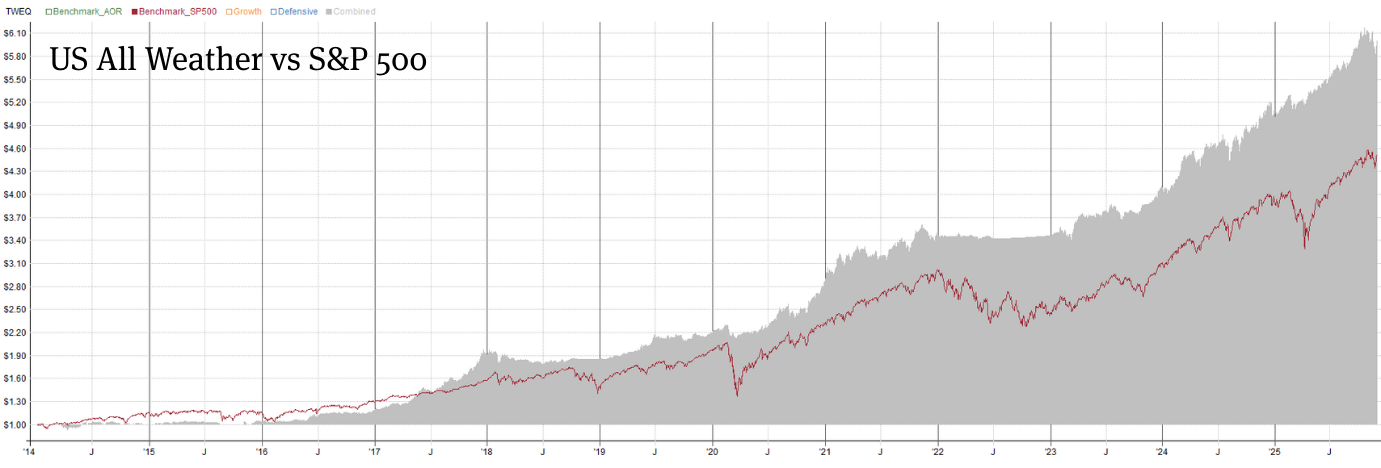

If we’re going to test a hypothesis or a new configuration, we first need a baseline to compare with. In this case, that will obviously be the current US All Weather model, as traded within The Chartist membership portfolio.

Unlike our other systematic strategies, which trade purely stocks, the All Weather strategies use ETFs as a means of achieving broad exposure to a variety of markets, commodities, and assets. The goal here is to provide low volatility returns while keeping drawdowns to an absolute minimum. The All Weather achieves returns not by chasing the returns of individual stocks but rather by shifting allocations towards overperforming assets away from underperforming assets. For example, if the stock market is underperforming, we might shift our allocations toward bonds or commodities like gold. The base US AW model shows a CAGR of 16.23%, with a MaxDD of -9.77%.

So, if our goal is to keep drawdowns to a minimum, doesn’t it make sense to cut our losses on a falling position?

Comparison

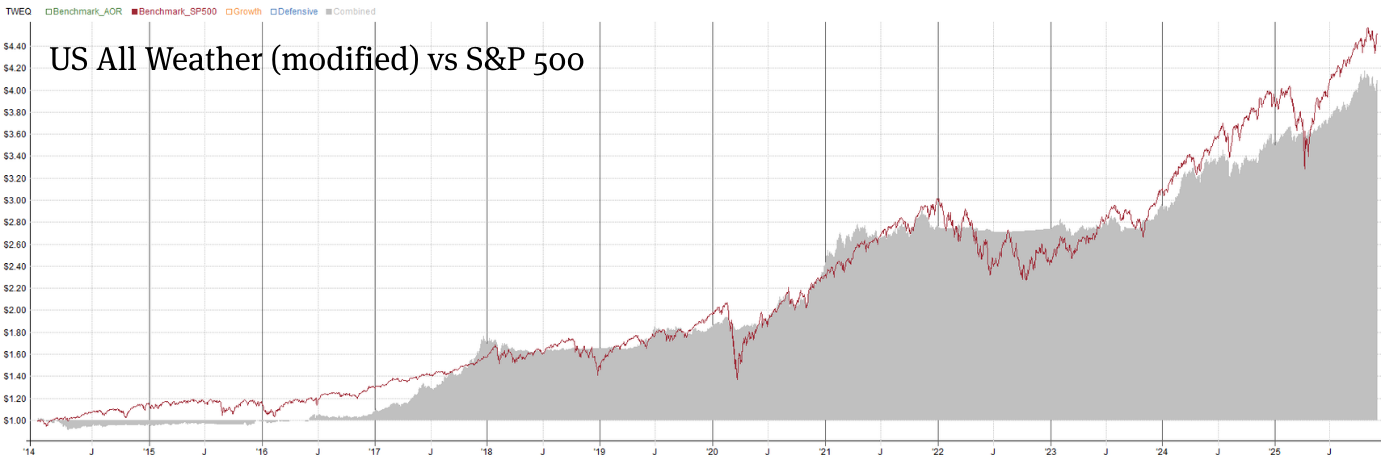

Below is a test implementing an immediate intra-month exit on any position that falls below its own 200 day moving average. The resulting CAGR is 12.54%, with a -10.53% MaxDD.

Obviously that performance is slightly worse than our original case, and the same is true when I test every MA length from 1 to 500.

Why does the return not improve?

There’s a lot of data and variables here, so there isn’t going to be a single answer, but here is one theory.

The average expectancy of the base strategy is 2.39%, compared to 1.83% on the intra-month exit version. The expectancy is a measure that tells us the return we can expect on each individual trade, based on the historical (or backtested) trades. In this case, there is a fairly large gap between the two expectancies.

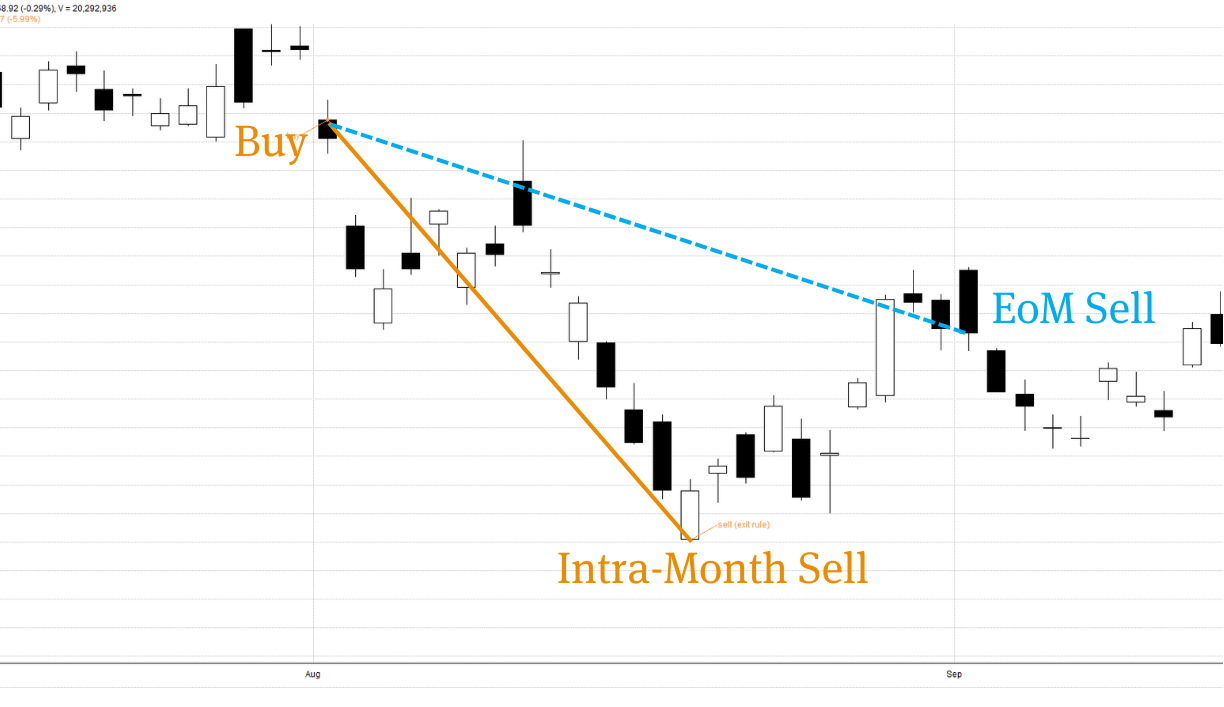

Since the only change in this test is the exit mechanism, with the entry mechanism remaining unchanged, we can deduce that an intra-month exit may force a premature exit at a low point. On average then, if the positions had waited until the end of the month to exit, they would have recovered some of their losses. We can see this in the example trade below, which saw a -5.99% loss at an intra-month exit. However, if the trade had hypothetically stayed until the end of the month, the loss would have been -2.14%. Obviously this is a cherry-picked example, but it exemplifies the point.

Rebalancing to Keep Control

Remember, the All Weather is a strategy based around allocation, not timing, and one other factor at play here is how the All Weather portfolios are constantly rebalancing positions at month end. This keeps any single position from having an overbearing influence on the portfolio. The Bitcoin position is a perfect example of this.

Investing is all about compounding returns, and the returns on Bitcoin have compounded A LOT in the past few years, more than any other holding within the All Weather strategy. However, we have made a deliberate decision to put restraints on the Bitcoin’s position size to prevent its volatility from spreading to the strategy’s overall volatility. If we allowed the Bitcoin position to grow without redistributing its profits, then it may well have become over 50% of the entire portfolio’s holdings. This would mean the portfolio would eventually track the volatility and losses of Bitcoin. Remember, the magnitude of losses scales up with the compounding growth of the asset.

However, if we rebalance Bitcoin (or any other position) each month as necessary, we redistribute its growth to another position or across all positions. In this way,

- The entire value of the portfolio continues to increase,

- major losses on any single position are reduced,

- the volatility of the broader portfolio is kept in check, and

- we essentially ‘supercharge’ the defensive assets by feeding them the profits from the growth assets.

Do we lose out on profits by not allowing the growth assets to compound freely? Probably, but growth isn’t the only aim of the All Weather strategy. The goal is to provide that growth while reducing volatility and keeping drawdowns to a minimum, which we have successfully done in this instance.

In Conclusion

While it’s uncomfortable to watch the Bitcoin position fall, historical backtesting tells us that exiting positions before the end of the month can be detrimental to the portfolio’s returns in the long run. Furthermore, the portfolio is set up in such a way as to exploit Bitcoin’s growth while also reducing its ability to drag down the entire portfolio. After all, the All Weather is a strategy based around allocation, not timing.