The Spectre of Stagflation

A spectre is haunting the United States: the spectre of stagflation.

In June of this year, shortly after the decision to keep interest rates unchanged, U.S. Federal Reserve Chair Jerome Powell remarked, “If it turns out that inflation pressures do remain contained, then we will get to a place where we cut rates sooner rather than later.” Since then, however, inflation has risen steadily, yet on Wednesday, the Fed not only announced a rate cut but also signaled that additional cuts may follow before the year’s end. While Powell never used the term “stagflation” in his remarks, the word quickly dominated headlines across major news outlets. So, what is stagflation, what historical parallels are there, and what does it mean for investors in the short term?

What is stagflation?

‘Stagflation’ is a portmanteau of ‘stagnation’ and ‘inflation’. The stagnation part reflects muted economic growth, including high unemployment and slow or stagnant GDP growth, while the inflation part reflects rising inflation. On its own, the inflation part is hard enough to deal with, but when combined with stagnant growth, the measures necessary to solve one problem can exacerbate the other. Generally speaking, to fight inflation, a central bank (in this case the Federal Reserve) will raise interest rates. The aim is to make borrowing more expensive and, in turn, reduce investment and demand, ‘cooling’ the economy. However, if the economy is too cool to begin, cooling it further might make businesses reluctant to expand and hire new employees, further stagnating the economy. Conversely, allowing inflation to persist unchecked leads to a decline in purchasing power, a decrease in consumer and business purchases, and an increase in stagnation.

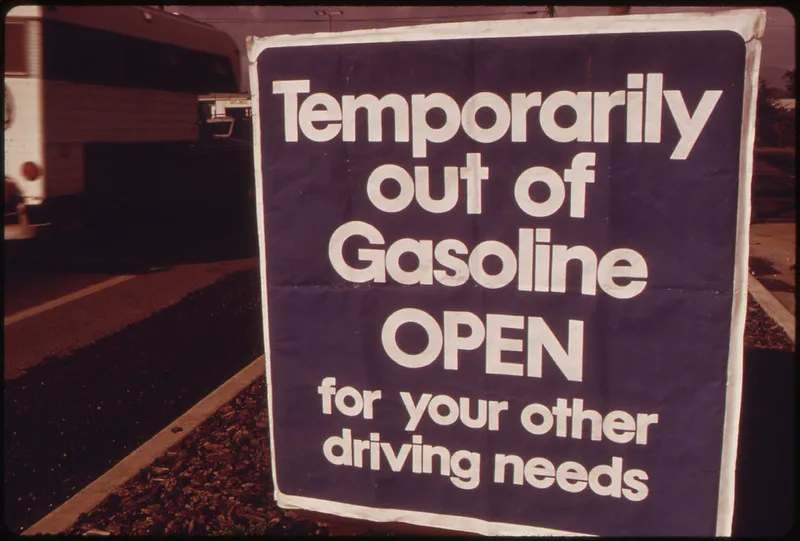

The most famous period of stagflation was triggered by the 1973 energy crisis, in which OPEC placed an embargo on oil to the US. Oil, which was the backbone of the American economy, saw its price soar overnight, leading to immediate rises in the price of practically everything as shipping, transportation, and production costs ballooned. The dramatic increase in production costs prompted businesses to reduce their output due to the higher input prices. Thus, an environment of stagflation was created, as policymakers were faced with the task of balancing growth and inflation. The eventual solution to the problem was to fight inflation, which at that point had risen to double digits, even at the expense of short-term growth, leading to recession in the early 1980s.

Why is stagflation being discussed now?

The fear of stagflation has begun looming again as the US job market appears to be weakening while the Fed struggles to get its inflation rate back to its target level of 2%. Fed Chair Powell noted that job creation is currently below breakeven, meaning that unemployment is rising. The decision to cut interest rates alongside recent Fed meeting minutes shows that the Fed currently sees unemployment as a bigger risk than inflation. The Fed points to significant causes of the labour market slowdown as lowered demand for labour as well as a sharp drop in immigration, saying:

“Labour supply has softened in line with demand, sharply lowering the ‘breakeven’ rate of job creation needed to hold the unemployment rate constant. Indeed, labour force growth has slowed considerably this year with the sharp falloff in immigration, and the labour force participation rate has edged down in recent months.”

With regard to rising inflation, the Fed points to tariffs being the main cause, now pushing up prices across some categories of goods, with the full effect to be seen as the effect ripples through the supply chain.

Is all of this truly a problem? Despite the weakening job market, the GDP grew 3.3% in Q2, and consumer spending remained high. But, a lot of this GDP stimulus is coming from the continued AI boom and related spending. According to JP Morgan, AI-related spending contributed a massive 1.1% to GDP growth in the first half of 2025. On the other hand, while consumer spending continues to rise, recent data from Moody’s suggests the top 10% of income earners accounted for 49.2% of the total spending in the last financial quarter. All this is to say the current growth appears to be coming disproportionately from the very top rungs of the economy.

What does this mean for investors?

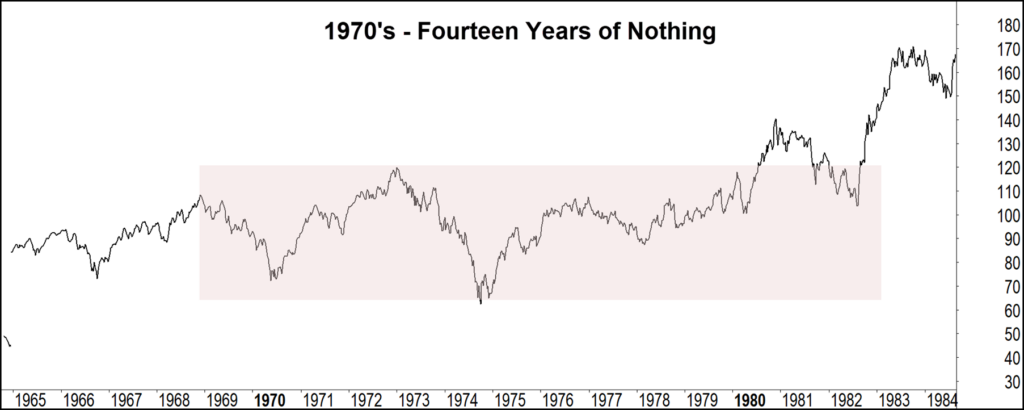

If stagflation kicks in, which it hasn’t yet, we could face another “lost decade” like the 1970s and 2000s after the dotcom bubble burst. For companies, inflation erodes the value of earnings and raises the prices of inputs, leading to less output and diminished profits. Lower earnings and profits mean lower share price growth. Furthermore, uncertainty about inflation and rates leads to higher volatility as the market becomes less predictable and forecasting becomes difficult.

One solution presented to the problem for investors is an All Weather strategy, which aims not to match any specific market environment but rather to offer reasonably satisfactory returns across all economic climates. Instead of relying on prediction (which becomes incredibly difficult during times of uncertainty), All Weather strategies are built on balance, spreading risk across assets with varying performance across economic environments. All Weather strategies diversify beyond stocks, which typically perform poorly during times of stagflation. For example, during times of stagflation, long-duration bonds can still provide protection, while commodities such as gold may offer growth, as they have historically rallied during stagflationary periods.

The other measures necessary for those who will continue to trade equities (we certainly will be) are to have a regime filters or other protective measures in place to prepare for any potential downturn. Regime filters can significantly reduce drawdowns that come with market shocks and sudden moves. Such as those that might be seen during times of stagflation, significantly reducing the pain threshold necessary to keep trading through these periods. Furthermore, a tactical directional strategy is also well -positioned to profit during “lost decades”.

Preparing, Not Predicting

At present, stagflation is more of a risk than a reality; warning bells are ringing, but there’s still time to steer the ship away. A slowing job market, sticky inflation, and growth concentrated at the top end of town point to an economy that may be in for some turbulence if confidence falters.

However, markets ultimately reward persistence, patience, and preparedness. Now is not a time to panic but a time to prepare. By building resilient portfolios, such as our All Weather Strategies or Multi-strategy, investors can not only stay protected through the turbulence but also grow. The key is not to predict the next market movement down to a tee (nobody can do that), but to be prepared for any situation that may arise.