Slippage and Gaps: What You Need to Know

You place a trade at a certain price, but it ends up filling at another. What happened? What you’re likely seeing is slippage or gaps, two unavoidable concepts that can have a massive impact on the outcome of your trading. While you can’t eliminate them completely, understanding and managing both helps minimise their impact.

What is slippage?

Simply put, slippage is the difference between the price you expected a trade to execute at and the price it actually executed at. If you place an order to buy a share at $10, and the order executes at $10.10, that additional 10 cents is the slippage. It may not sound like much, but if you’re buying 1000 shares, that’s a $100 difference on the trade. If you then apply this logic to every trade you make, you can see how it becomes a problem.

What are gaps?

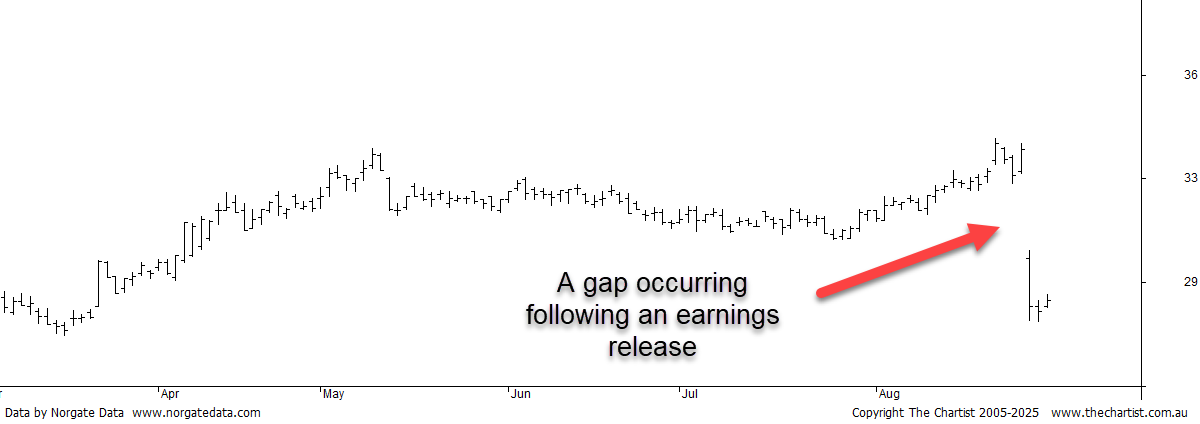

In trading, a gap is a sudden jump or fall in a stock’s price, usually caused by significant news or events such as earnings releases and takeovers occurring outside of market hours. A gap appears on a price chart as a literal gap or space between bars as shown below. When occurring at a trade’s entry or exit, gaps can be seen as significant events of slippage; it is not uncommon for stocks to move as much as ±20% on open following significant earnings releases.

What causes slippage and gaps?

There are a number of reasons that slippage and gaps occur, but fundamentally they all go back to supply and demand. Stock prices are not set by any individual; they are the result of constant negotiations between traders buying and selling. The changing tides of these negotiations alter the spread of offers, which in turn moves the price. Slippage is more likely to occur with:

- Low liquidity: If there are few buyers and sellers for a given stock, the price can move suddenly based on the limited orders available.

- High volatility: Stocks with high volatility generally incur more slippage as the price moves rapidly in either direction

Gapping is more likely to occur around:

- Earnings season: During earnings season, prices can move rapidly as earnings are released. Even if earnings aren’t coming directly from the stock in question, related stocks can move the price quickly.

- Major News Events: Gaps can occur around major news releases, which make investors reassess a stock’s value quickly. News events such as guidance changes, product launches, legal issues, CEO departures, geopolitical events, tariffs, supply disruptions, or news from competitors.

- Stocks going ex-dividend: For stocks that pay out dividends to investors, there is a date of purchase from which the buyer is no longer entitled to the next dividend. On this date, the stock’s price will generally drop by the value of the dividend. This date is predetermined and will be publicly available, though it can still take traders by surprise.

Managing Gaps and Slippage on Entry

Although gaps and slippage are unavoidable, traders can take measures to mitigate their impact.

The best way to avoid major cases of slippage and gaps when entering a trade is by using limit orders instead of market orders. A market order fills an order as soon as possible at the best available price. This means a market order has no protection against sudden stock movements. With a limit order on the other hand, the trader specifies a maximum price against which the trade can be executed. If the limit is exceeded, the trade is not made until the price comes back within the limit range. However, with this approach the trader risks missing the entry entirely if the limit is gapped over. Thus, it is important to assess whether the trading strategy lends itself better to a tight entry price or making an entry at any cost.

Another way to avoid slippage is by limiting exposure to low liquidity or high volatility stocks. If you use a systematic trading strategy, add filters to avoid thinly traded stocks or those with wild price swings.

To avoid large downward gaps, some traders stop trading entirely around periods of major news releases, market turbulence, or earnings season. This is more applicable for short-term or discretionary-type strategies.

Can Slippage Be Positive?

Yes, slippage isn’t always a bad thing. To take the example used earlier, if you place an order to buy a stock at $10 apiece, but this executes at $9.90, you are 10 cents better off for each share purchased. However, slippage is more likely to be negative as brokers prioritise execution speed over price improvement. Therefore, you’re better off trying to mitigate slippage rather than hoping for a lucky price execution.

In Summary

Slippage and gaps are an unavoidable part of trading that can often take beginners by surprise. They can’t be avoided, but they can be managed. By using limit orders, avoiding low liquidity or highly volatile stocks, and being aware of upcoming news events, you’ll reduce their impact on your trading account. Think of them not as failures, but as part of the cost of participating in the market, one that smart preparation can keep under control.

To learn more about our portfolios and gain access to our education center, take our 14 day Free Trial.