Portfolio Capital and Strategy Allocation

Nick Radge has been asked, “What allocations do you recommend to the various markets and strategies as capital grows?”

Whilst the answer will be different for everyone, Nick can tell you how he allocates his capital across various markets and strategies.

What Allocations do you Recommend to the Various Markets and Strategies as Capital Grows?

This is a question I get asked a lot. I cannot advise you personally but I can explain what I do.

As you know, I trade multiple strategies and I’m a big believer in strategy diversification. Most people will suggest that you have a diversified stock portfolio. Well, I just do it with strategies, that’s all. My goal here is to have different strategies in different market types, trading different styles and different timeframes.

I guess the key takeaway for me at least is strategy diversification, and that will depend on three things. It will depend on the amount of capital you have available, obviously, if you have limited capital, then commission drag starts to become more of an issue, especially with shorter-term strategies. So, it may not be appropriate.

If you’ve got limited capital, you can probably trade lower frequency strategies, say something like the ASX Momentum and the U.S Momentum. That way you get diversification into two different markets and they’re low frequency kinds of strategies. Commission, drag and frictions will be very limited.

Dependent on these 3 Things.

The first thing is available capital. The second thing is available time, obviously, if you have a busy family, you’ve got a career or you do a lot of traveling, then day trade strategies, for example, or systems that need to be operated daily may not be appropriate for that. It may well be that you select a weekly program such as something like the Weekend Trend Trader or a monthly program, like the ASX Momentum or the U.S Momentum. The third thing is market accessibility, and it could be that your broker doesn’t facilitate certain order types, for example, my day trade strategy requires an API. It requires connectivity and certainly in Australia, there’s really no brokers that allow that kind of stuff to happen.

So, if you use a very basic kind of broker, then trading those kinds of strategies, won’t be available, and therefore you either need to change broker or look at a different kind of strategy. Same thing, if you have a strategy that uses stop-loss orders, you may use a broker that doesn’t facilitate stop-loss orders. So, you either have to change brokers or you need to change strategy.

To Help Answer the Question

As a basic to answer this question, the basic suggestion from me would be, look 50% allocation to the ASX, 50% allocation to the U.S and if you’re new to it all just use very simplistic kind of strategies. I can’t stress that enough. A lot of people come into trading with visions of grandeur and all sorts of stuff, but after a month or two, the daily workload becomes too much for them. They don’t have the discipline to stick to it.

So if you trade a monthly strategy, like the U.S Momentum or the ASX Momentum, you can literally just put it in your calendar and forget about it for the whole month. There’s nothing to do intra month, put it in your calendar. You get the wake up call at the end of the month, run the orders, place them, and away you go. So, that would be the very basic kind of example there.

Nick Radge’s Portfolio Allocation

Now, in terms of me personally, the following image represents about 70% of my full exposure to the stock market, Trish and I do have a strategic portfolio that holds positions in certain strategic companies for a long-term. We’ve had positions, some of those positions for up to 20 years, but that’s not included in these numbers. And that represents about 30% of the total. So, the rest of the trading portfolios is about 70% of our exposure to the stock market.

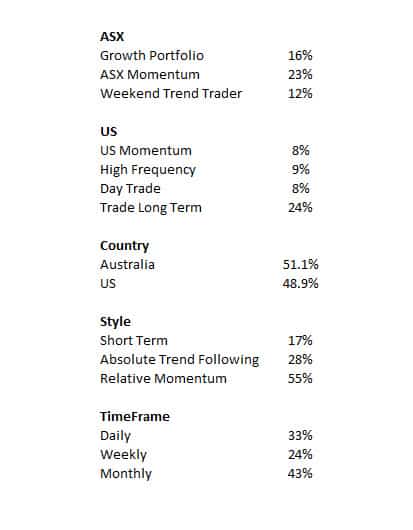

Nick Radge’s Capital and Strategy Allocation

Now, you can see here that the ASX is a little bit heavy on the longer term strategies, Growth Portfolio, ASX Momentum, and Weekend Trend Trader. That’s because a lot of that money is actually our super fund. Therefore we’re limited to what we can actually do with that, short-term trading in a super fund is not overly appropriate. The ASX Momentum doesn’t operate in the superfund, but both the Growth Portfolio and the Weekend Trend Trader do. That represents about 28% of that total. The country split there is about 50-50.

In terms of style, I’m a little bit short, still on the short side of things, I’ve only got 17% allocated to short-term trading, and that would be our high frequency strategy and the day trade strategy. It’s my intention to double the allocation to the day trade strategy in the next drawdown. But at the moment I’m at new equity highs there and it’s cruising along pretty good. So, I just want to wait for a drawdown of around 10 to 12%, which will come. At that stage, I’ll reallocate or re-weight some of that money into the day trade strategy. 50-50, more or less in the country allocation, in terms of the style, 17% only to short term, 28% to absolute trend-following and relative Momentum about 55%.

Trade Long Term Portfolio

Now, the Trade Long Term portfolio there is quite heavily weighted. That’s because last year that portfolio returned 97%. I think we’re up about 26% this year in that portfolio. So, that needs to be rebalanced. I actually should have rebalanced at the start of this year, but that needs to be done. We’re going to increase the allocation to the day trade strategy there.

So, three different styles of strategy and the timeframes, 33% daily operational, the Growth Portfolio for example, is daily operational. But that doesn’t mean I do anything on a day to day basis. We can hold positions there for quite some time and not do anything in any way, shape or form.

Weekly Strategy

The weekly strategy is 24%, monthly allocated 43%. Again, a lot of that is that trade long-term, which operates both on a weekly and a monthly timeframe. If we even break it down further, if we look at the ASX there. The Growth Portfolio basically trades the industrial stocks outside of the ASX 100. The ASX Momentum only trades the ASX 100 stocks. The Weekend Trend Trader is calibrated to trade smaller cap stocks outside, really outside the ASX 500.

I’m getting a good spread across the whole market there. Big caps, intermediate caps, and the very smaller caps as well. So, what we’re doing here is diversifying across everything. The concept is that, not every strategy is going to work perfectly well all of the time. But over the long term, all these strategies have very good return metrics. It’s just a matter of allowing them to run their course over the long-term and in the short-term. There’s going to be some ups and downs.

To give you an example.

The trade long-term portfolio, as I had said before, last year made a return of 97%. Then we went into a pretty stiff drawdown earlier on this year. I think we were down at some stage there about 25%, and we’re now up 26%. So, they’re just the swings and roundabouts of that kind of trading. The whole idea of putting them all together is some will do poorly, at certain times of the year. Others will do very, very well. The Day Trade portfolio, for example, it’s up 40% year to date. So, it’s offset what’s going on with the Trade Long Term and same with the U.S Momentum, it was actually performing really, really well at the start of the year, whilst the trade long-term portfolio was performing poorly.

The whole idea is to keep the equity curve moving and not being reliant on a single strategy. What we tend to find, if someone relies on a single strategy if it goes into drawdown. Then they become quite disheartened and can tend to drop it or switch to something else. Portfolio or performance chasing is a very common error that a lot of people make. By trading multiple strategies, you kind of alleviate that to some degree.

So, that’s a bit of an idea of how I split our money up. As I said, this represents about 70% of the funds that we have allocated to the stock market. The other 30% is in our strategic portfolio. I hope that’s helpful and happy to answer any other questions.