How to Trade the US All Weather for European Clients

Since the launch of our All Weather strategies, we’ve had frequent enquiries from European clients about how they can utilise these strategies without investing directly in US ETFs. As such, we’ve decided to begin listing comparable EU UCITS ETFs within the US All Weather Strategy within the next few weeks.

What are the All Weather strategies?

An All Weather strategy is a low-volatility, low-effort investing approach designed to weather all market conditions. When the economy is strong, the strategy will aim to make you some money, and when things are not going so well, it will try to protect your money from big losses. It’s like having a financial umbrella that keeps you dry when it rains and a sunhat for when the sun shines, all in one.

The Chartist All Weather strategies achieve this through broad diversification through a number of asset types. Yet, the process is kept simple using ETFs, meaning full exposure can still be achieved through a standard broker or restrictive trading accounts such as pensions or superannuation accounts.

What are UCITS ETFs?

Undertakings for Collective Investment in Transferrable Securities (UCITS) is a designation for investment funds, including ETFs, to be traded throughout the EU after being authorised by any member state. This means a UCITS-compliant ETF is tradable across EU borders.

Why not buy US ETFs directly?

Most European retail investors are unable to purchase US-domiciled ETFs due to PRIIPs regulations. This means that US-listed ETFs are only available to professional investors within the EU, which requires certification to achieve. By using comparable ETFs domiciled within the EU, traders can gain the same exposure while avoiding unnecessary barriers.

A further consideration is the potential tax impact of investing in non-EU-domiciled ETFs. While tax treatment varies by country, many EU investors may face higher withholding taxes or less favourable tax treaty terms with U.S.-domiciliated assets compared to UCITS funds domiciled within the EU.

How does currency exchange factor into this?

We have specifically chosen ETFs quoted in USD but listed on EU exchanges, so all trades are still managed in USD. Investors can choose to hedge their currency exposure as needed.

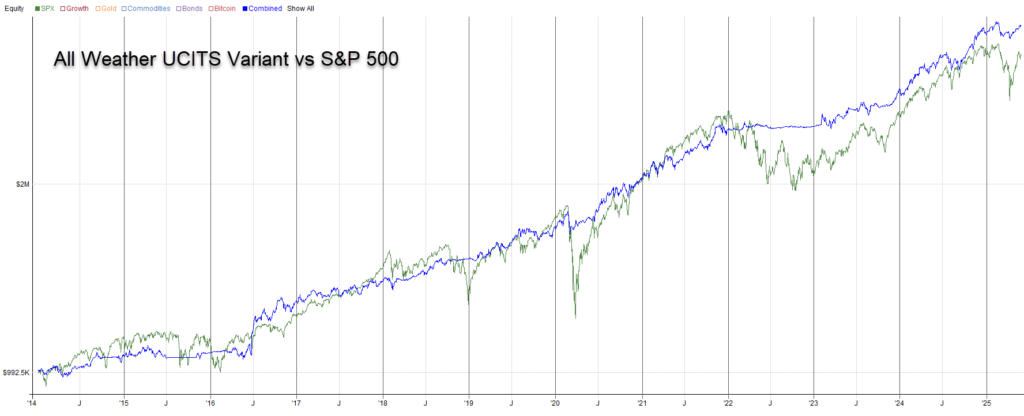

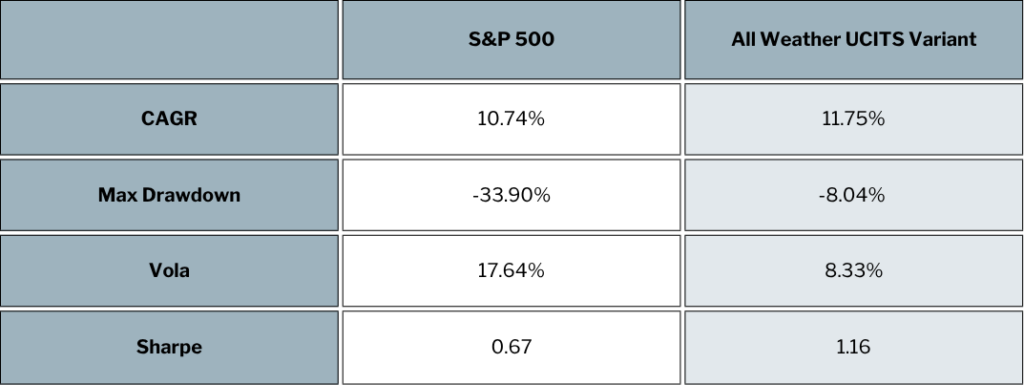

Is the performance comparable?

For the most part, the ETFs are a one-to-one replacement for the ETFs used in the US All Weather; however, there are some slight differences.

Most notably, there are no UCITS Bitcoin ETFs available. Part of the UCITS framework is that funds must be diversified; specifically, funds must not have more than 10% of their investment in securities issued by the same body. Instead, we can allocate that segment of the portfolio to an ETF consisting of multiple cryptocurrencies, rather than exclusively Bitcoin. Alternatively, investors following the portfolio could opt to invest in Bitcoin directly if possible.

Of particular note is how the portfolio variant outperforms the S&P 500, while bringing the maximum drawdown considerably from -33.9% to -8.04%. Thus, the UCITS variant of the All Weather portfolio surpasses the brief of offering low-volatillty, low-effort growth.

When will the UCITS variant be available?

The EU UCTIS variants will be added to the US All Weather portfolio in the coming weeks. This is available through The Chartist US or The Chartist Pro memberships.