ETFs as Regime Filters

Today I thought we’d answer a client question from Vinit, who asks, “Can ETFs be used in place of indexes in regime/market filters?” Great question, Vinit.

What is a regime filter?

A regime filter, also known as an index filter or a market filter, is a trading system component used to define the broader trend of the market environment. At The Chartist, we use regime filters in our strategies to revert to cash when market conditions deteriorate, aiming to sit out market downturns or periods of turbulence. When used well, regime filters can greatly reduce drawdowns in strategies.

Regime filters can be as simple as a moving average placed on a market index. For example, the chart below shows a 100-day moving average overlayed on the S&P 500 index. Used as a regime filter, the strategy would look to invest while the index is above the MA and trending higher, then take a defensive position and move to cash when the index moves below the MA.

They can also take on more complex forms, encompassing breadth, volume, volatility, or more. You can read more about regime filters here.

Can ETFs be used in regime filters?

Exchange-traded funds (ETFs) are a unique kind of instrument that can be used to track a basket of assets or a subset of the market. In this way, the performance of an ETF represents the performance of the underlying assets. Thus, an ETF can be used in a regime filter as a way of measuring the market environment against data that would otherwise be difficult to access.

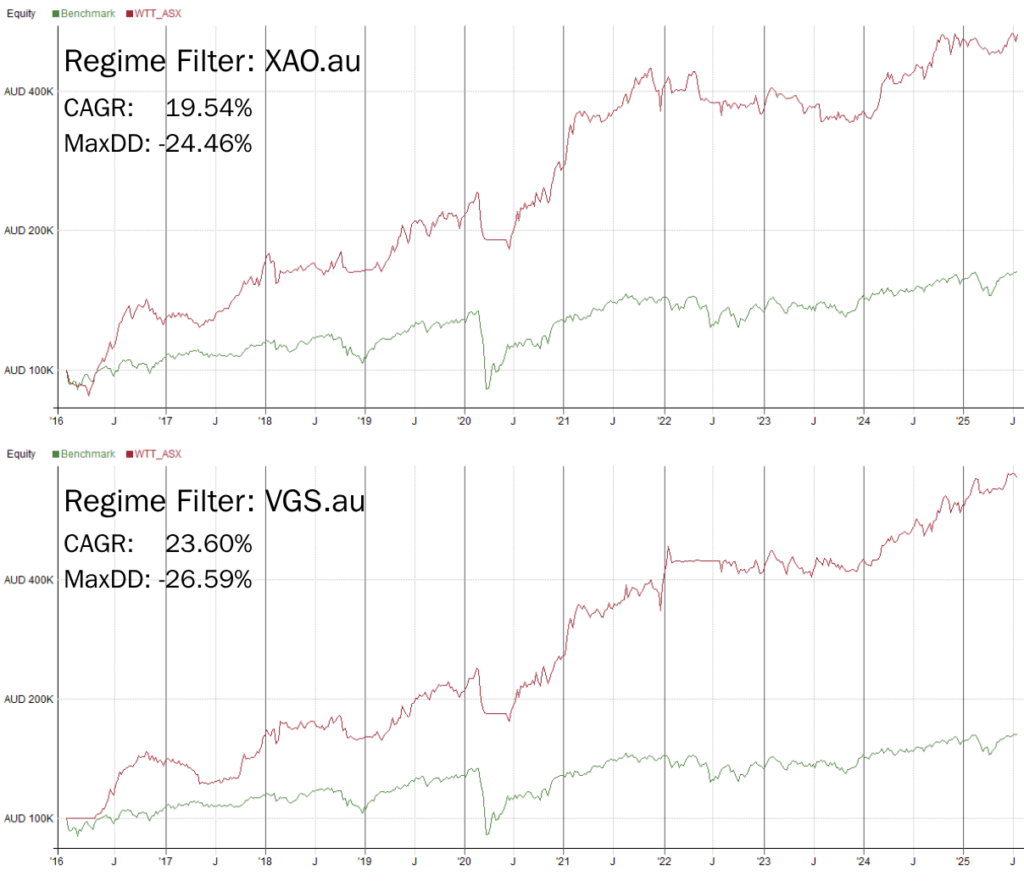

Take the charts below, for example. The first chart shows our standard Weekend Trend Trader turnkey code on the ASX, which uses the ASX All Ordinaries as its regime filter. The second chart shows the exact same strategy, with the regime filter looking at an ETF that represents global shares (VGS.au, or Vanguard MSCI Index International Shares ETF). This ETF represents the performance of 1300 companies across 23 countries, so it can be said to represent the global market environment, as opposed to just the Australian market. In this case, the hypothetical CAGR has risen from 19.54% to 23.60%; however, the maximum drawdown has slightly increased.

Downsides of ETFs in Regime Filters

One of the biggest limitations of this approach is access to historical performance data. Many ETFs have not been around for lengthy time periods, so the method can be prone to recency bias. VGS.au, used in the above example, was listed in late 2014, meaning we have just over a decade of data with which to test.

Secondly, some ETFs are discretionary in nature, with the underlying stocks or assets picked by fund managers, as opposed to an index such as the All Ordinaries, which simply consists of the top 500 Australian stocks by capitalisation. The use of discretionary ETF funds could introduce unexpected results to a systematic strategy.

Have your own trading strategy ideas you’d like to test out? Have a look at our Beginner’s Guide to Building Trading Systems course to learn to build and test your own strategies.