Are You Really Diversified? The Truth About Index ETFs

As traders, we often use market indexes as a proxy for the performance and health of the overall stock market. After all, the Nasdaq-100 tracks the performance of the largest 100 stocks listed on the Nasdaq, while the S&P 500 tracks the top 500 US companies, so they must be reflecting the market’s health, right? Well, yes, but also no.

These two indexes are the most often discussed—you’ll hear them on the news every night—but they’re also frequently misunderstood. Many assume these indexes are simple averages of all their constituents, but this is not the case. In reality, the Nasdaq 100 and the S&P 500 both use market capitalisation weighting. That is, each constituent is weighted according to their total market value. So simply put, the largest companies have greater influence than smaller companies over the index’s performance.

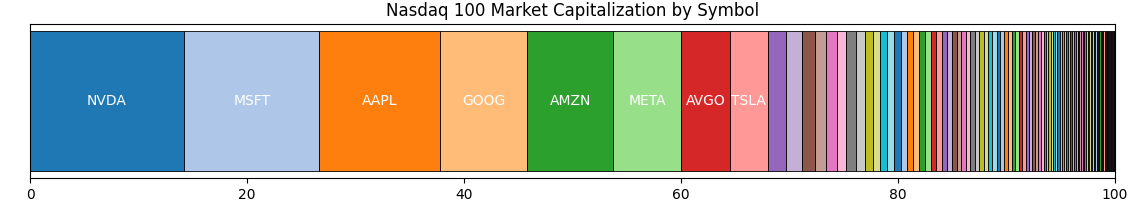

This sounds completely reasonable until you realise how large the capitalisation of the biggest companies has become. In the Nasdaq 100, the top 5 companies (Nvidia, Microsoft, Apple, Google, and Amazon) represent more than 50% of the entire index. Looking further, the top 15 companies make up 75% of the index. The inverse of this, of course, is that the next 85 companies represent only 25% of the index. You can see this skew represented visually on the chart below.

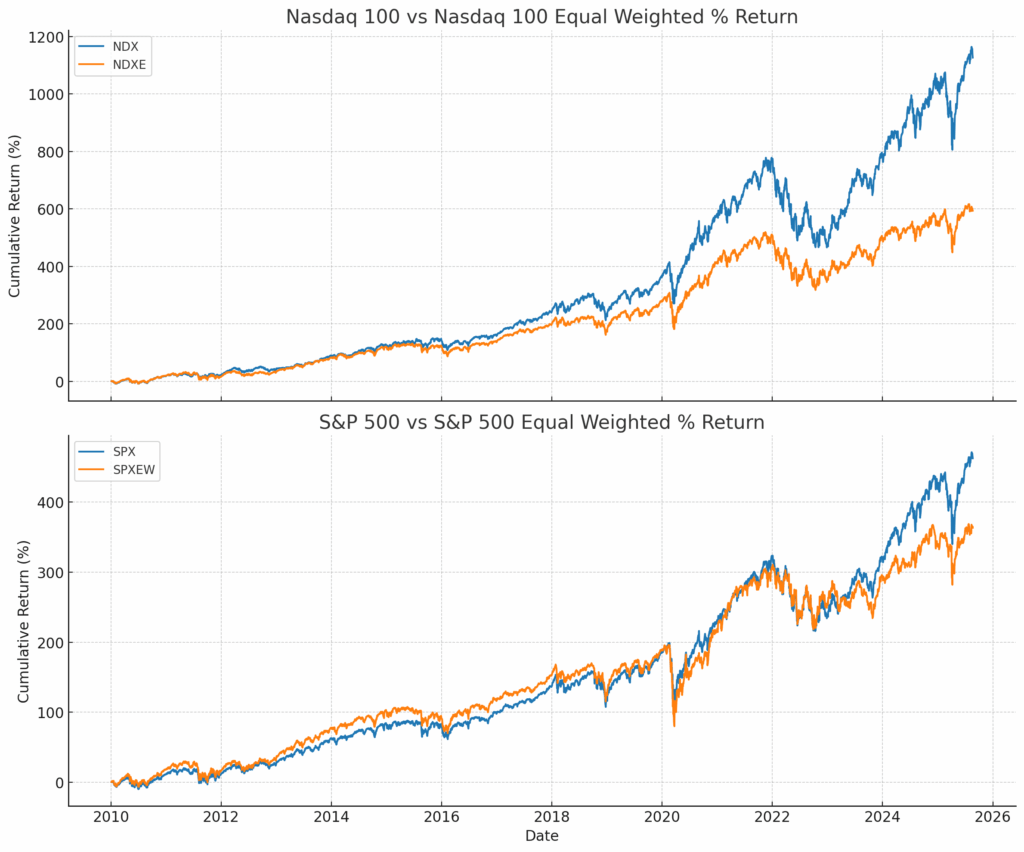

The same effect occurs on the S&P 500, which is calculated the same way, albeit with five times as many constituents. The top 10 stocks on the S&P 500 account for roughly 35% of the total index performance. This dramatic skew in the weighting can greatly distort the performance results of the indexes. This is especially concerning given the top constituents are all tech companies, which tend to rise and fall at the same time. The result is that these indexes aren’t really reflecting the health of the overall market but more so the fortunes of a handful of tech giants. Because of this, the S&P 500 could see hundreds of companies finishing a day with losses but still show an overall gain if only a few of those large tech companies have a strong day.

By comparing the performance of the standard market-cap-weighted indexes with the equally weighted versions below, we can see how dramatically different the outcome in performance becomes over time.

However, the real problem here isn’t mere data anomalies or skewed charts. Investors commonly buy index ETFs or invest in index funds with the expectation of receiving diversification across a broad range of companies, not realising how skewed their allocation will be. The reality is by buying into a standard-weighted Nasdaq 100 or S&P 500 index ETFs, the investor is putting the majority of their investment towards large-cap tech stocks. To put this into dollar terms from the earlier data, if you put $100,000 into a Nasdaq 100 index fund, $50,000 of that would be going towards just five companies.

The capitalisation-weighting of indexes is a self-fulfilling problem, as when passive investors allocate capital to index funds with the same weighting, they inadvertently continue to inflate these larger companies. I wrote about this phenomenon earlier in the article Is Passive Investment Creating a Bubble?

Because of this weighting, a sharp downturn in AI or semiconductors could lead to a sharp collapse in the overall indexes. Similar to that seen in the early 2000s dot-com bubble. Therefore, investors looking to index funds or ETFs for diversification investing should be aware of the underlying constituent weighting and how this affects diversification and performance. If you’re seeking low-volatility returns, you should consider hedging index investments with exposure to alternative assets such as commodities, treasury bonds, global markets, or even cryptocurrencies. Low volatility trading strategies such as our All Weather portfolios take these factors into consideration.