Positioning for the Next Opportunity: Making the Most of Portfolio Protect

Over the past few weeks, we’ve seen heightened turbulence in global markets and a sharp rise in volatility across indexes. Overnight in the US, we saw a strong opening for indexes on the back of positive forecasts from market trendsetter Nvidia, only to be completely wiped away by the strongest intraday reversal since the April tariff turmoil. Dragged down, the S&P 500 has returned to September levels. In the background, bitcoin has experienced a consistent slide from all-time highs of $125k to now sit below $90k. The situation is tenuous.

The current evolving market situation closely resembles the scenarios our regime filters are designed to address. Our Growth Portfolios, in fact, have already moved to Portfolio Protect mode, while many others look to be heading in the same direction, depending on how the next week plays out. As we near the end of the month, I thought I’d take the time to address the common questions around Portfolio Protect, in the event that the portfolios do begin to enter this state.

What is Portfolio Protect?

Portfolio Protect mode is simply when we temporarily pause entries for our systematic strategies and sit in cash. Some portfolios may take the extra step of exiting all positions immediately. The idea is to simply sit out periods of significant market instability, protecting both our capital and our mental health. This protect system was developed after the GFC of 2008 and is based on extensive research and backtesting over long periods of historical data.

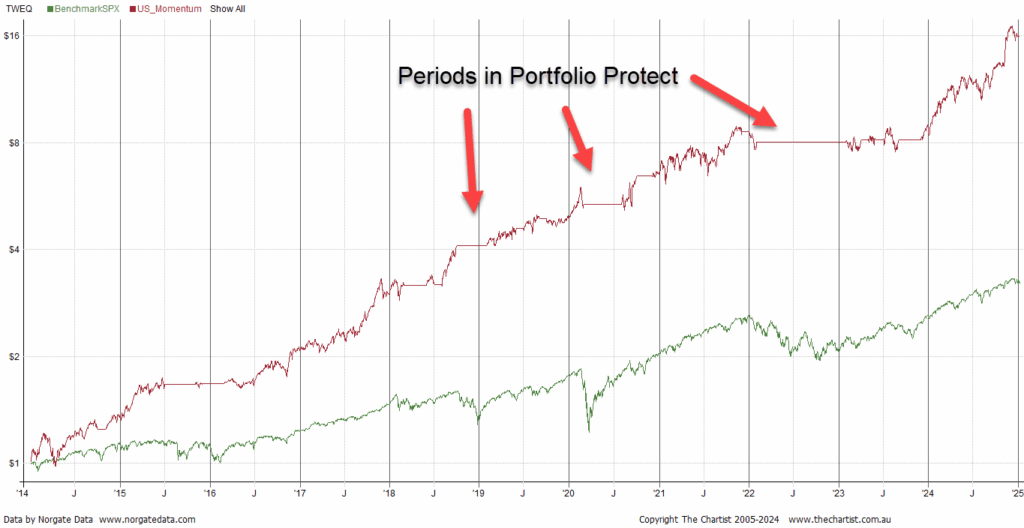

Since the GFC, the protect mechanism has proven incredibly effective across multiple portfolios at avoiding the worst of large market downturns and has been especially useful during the COVID market crash.

Why are we entering Portfolio Protect Now?

Portfolio Protect is controlled by regime filter algorithms that monitor market health and respond when conditions deteriorate, shifting to a defensive stance before drawdowns accelerate. Each of our subscription portfolios has its own filter system developed for the specific trading style of the strategy.

Aside from the obvious volatility I’ve already mentioned, we’re also starting to see a marked decline in market breadth; that is, the number of stocks rising proportional to the number of stocks falling is beginning to turn. Alongside the technical indicators, we can also see investor hesitancy beginning to mount, which can often be harder to measure. The most obvious sign is the near-constant discussion of an AI bubble and the usefulness of AI technology that has been the single biggest (some say only) driver behind recent market growth. Additionally, the sell-off in Bitcoin, which retail investors heavily own, indicates a decline in risk appetite.

It’s important to remember, however, that Portfolio Protect is a forward-looking defensive stance, not a be-all-end-all prediction of an imminent market crash. In the past, we’ve entered portfolio protect only for conditions to recover soon after. The portfolios simply pick up where they left off and reinvest. Do we sometimes miss out on potential growth? Sure. Is that better than simply waiting and praying a crash doesn’t happen? I certainly think so.

So, what can we do during portfolio protect mode?

Now, if you’re reading this newsletter, you’re here to invest, not to leave your capital sitting around. We get that. So, what are our options if you want to continue to invest our capital during a market downturn? (Key phrase here is “if you want to”. You do not need to do either of the below if you are happy to sit it out).

Firstly, it’s important to remember that holding cash is not ‘doing nothing,’ but rather an active decision made to enter a defensive stance and protect your capital. Moving to cash is not quitting or admitting defeat by any stretch. When conditions improve, we’ll move back in as soon as conditions are right to do so.

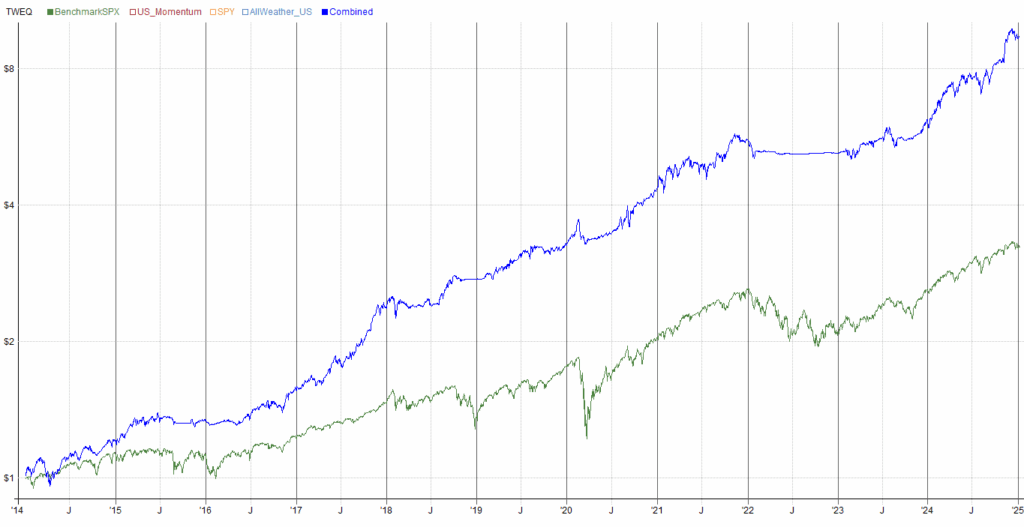

One option is to move your allocation from the growth-based strategies in Portfolio Protect to a defensive strategy such as the low-volatility All-Weather strategy. All-Weather strategies exist specifically to provide broad diversification beyond stocks. For this reason, they can continue to grow through periods of market turmoil by shifting allocation toward commodities or low-risk assets such as government bonds. The chart below demonstrates the US Momentum portfolio with the allocation shifting to the US All Weather strategy during portfolio protect periods. In particular, compare the covid crash period in the chart to the one above.

A second, and very conservative, option is to move your capital into an interest-bearing cash ETF to continue receiving gradual growth while avoiding drawdowns altogether. A cash ETF is one that invests in yield-based investments such as short-duration government bills, investment-grade cash instruments, or overnight deposits. Their goal is to provide stability while earning yields that track short-term interest rates. Such an investment is a suitable option for those looking to park their cash temporarily without removing it from their brokerage accounts. Before pursuing this option, check the interest rates on your brokerage accounts; some pay reasonable interest, while some pay none at all.

Why Portfolio Protect Matters

Regime filters and the portfolio protect system exist as a product of historical experience and thorough backtesting. They are a key part of The Chartist’s trading methodology and have a track record proving themselves incredibly effective across a broad range of market conditions and environments. Portfolio Protect mode is not a prediction tool but a risk-management framework that allows us to act systematically and without emotion during times of high stress. It ensures that when market conditions improve, we have the capital, clarity, and discipline to take advantage of the next opportunity.